Changing Weather Patterns Could Favor U.S. Wheat Production

Over the last few weeks, we have analyzed several factors that are shifting or have the potential to shift U.S. wheat value toward wheat importers. A combination of lower futures prices, a break in dry bulk freight prices, an increase in planted area, and the potential for a weaker dollar all point to a wheat […]

Markets Look for Weaker Dollar as Purchasing Conditions Improve

With recent breaks in U.S. and global wheat futures and lower freight rates, the wheat market seems to have turned a corner to favor buyers after two years of volatility and risk. Despite the improved general outlook, inflationary pressures persist, influencing macroeconomic conditions both in the U.S. and for our customers overseas. For example, major […]

Wheat Export and Production Issues in Focus, as Black Sea Grain Deal Discussions Continue

By Keith Good, Farm Policy News, Reprinted with Permission Late last week, Bloomberg writers Aine Quinn and Megan Durisin reported that, “After a slow start to the season, Russia’s grain exports are booming as buyers load up on its attractive bumper supplies. “The country’s shipments of wheat — its main crop — almost doubled in January and February from a year […]

U.S. Farmers Respond to Higher Wheat Prices by Planting More

Since Russia’s unprovoked invasion of Ukraine sent them soaring one year ago, global and U.S. wheat prices have decreased significantly. Continued Black Sea Grain Corridor exports and improved production outlook in major exporters such as Russia and Australia have helped relieve the market of some supply pressure. Bulk ocean freight rates have also broken in […]

Wheat Prices Trend Lower Even As Uncertainty Continues

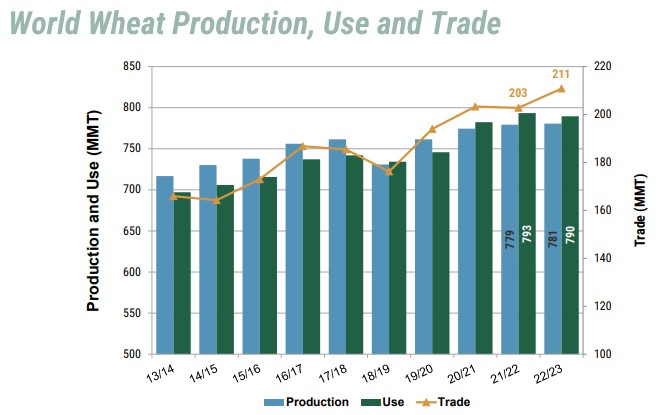

Following a year of dramatic volatility, several factors have pressured global wheat prices back to levels last seen before Russia’s invasion of Ukraine in early 2022. There are several factors behind this trend. In this article, U.S. Wheat Associates (USW) examines the tenacity of world wheat trade even in the face of serious market uncertainty. […]

Update – Looking Ahead to Winter Wheat Planted Area Estimates

USDA’s National Agricultural Statistics Service (NASS) will publish its first official estimate of U.S. winter wheat planted area for the 2023/24 crop on Jan. 12, 2023. Along with U.S. wheat importing customers, U.S. Wheat Associates (USW) will be watching trade estimates before the report is issued and make some comparisons to NASS estimates in 2022. […]

Quiet WASDE Includes Falling World Wheat Stocks

USDA released its December World Agricultural Supply and Demand Estimates (WASDE) report Dec. 9, 2022, that included no substantial changes for global and domestic wheat markets. Given the overall volatility in 2022, a somewhat calming report was probably a blessing in disguise for wheat buyers who should, however, keep an eye on declining global stocks […]

USW’s Crop Quality Seminars Successful in Highlighting 2022 Wheat Crop for Global Customers

Crop Quality Seminars presented by U.S. Wheat Associates (USW) concluded this week with a universal response by customers in every corner of the world: They are impressed by the high quality of the 2022 crop across all six wheat classes but concerned about the sustained higher prices. One other common opinion: Those attending in-person seminars […]

Surprising U.S. Small Grains Summary Report Added Market Volatility

With a significant decline in U.S. wheat production, the September 30, 2022, the USDA/NASS Small Grains Summary report took many wheat traders and analysts by surprise. The report estimated total production at 44.91 million metric tons (MMT) 1.65 billion bushels of total U.S. wheat production, down 3.62 MMT from August estimates. The quarterly report is […]

Headlines Keep the Global Wheat Market Bouncing

Grain buyers have the unenviable task of sorting through today’s news and determining what it means for tomorrow’s prices. Experienced buyers have plenty of tools to help with their decisions, but the volatility experienced in 2022 may be embedded for the near future. Talk of a global recession may soften commodity prices initially, but just […]