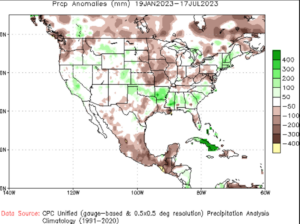

Source: NOAA Climate Prediction Center

Amid this year’s volatile markets and relatively slow demand, U.S. soft white wheat (SW) has provided many customers with buying opportunities, positioning itself as one of the most competitive classes of U.S. wheat.

In recent months, dryness in the Pacific Northwest (PNW) this spring dominated market news and discussions about quality. As harvest ramps up across the SW growing region, more information is expected to become available regarding SW production, yield, and quality. In the meantime, this article will recap the current soft white wheat situation and provide background on supply factors as harvest progresses in the PNW.

Production Outlook: A Tri-State Effort

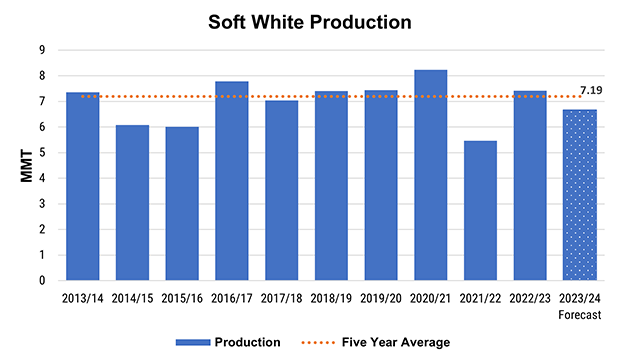

White wheat is typically one of the classes with the most stable planted area. The June 30 USDA acreage estimates showed a slight increase in white wheat acres to 4.28 million acres, up from 4.24 million acres in 2022/23, with a specific increase in the SW producing state of Oregon. Despite the increased area, dry conditions have lingered, and have had a potentially detrimental impact on yield potential and quality. The USDA Crop Production Report released on July 12 forecasts SW production at 6.7 MMT, down from 7.4 MMT the year prior and 600,000 MT below the five-year average of 7.2 MMT. However, the forecast is still above the 2021/22 production levels of 5.47 MMT after severe drought diminished yield potential and increased protein levels.

On a per state basis, production potential differs throughout the growing region. Wheat production is forecast to be down in Washington and Oregon by 15% and 16%, respectively. Meanwhile, in Idaho, all wheat production is forecast at 2.45 MMT, down 2% from the year prior. Though the Idaho crop is behind on development, some growing regions have benefitted from cool weather and scattered showers.

Source: USDA ERS Wheat Data

The Current Balance Sheet

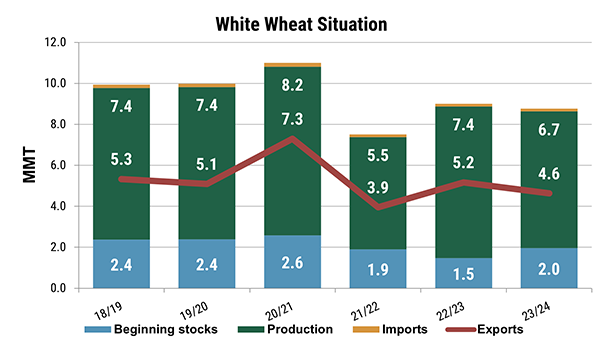

Throughout the latter part of the 2022/23 marketing year, industry sources reported slow selling by farmers and increased stocks held on the farm. Due to the increased stocks held by farmers, beginning stocks for the 2023/24 marketing year increased by 500,000 MT to 2 MMT, the first stocks increase since 2020/21. Though protein levels of the 2023 crop are not yet known, the increased old crop wheat stocks can be blended with new crop to help meet customer specifications.

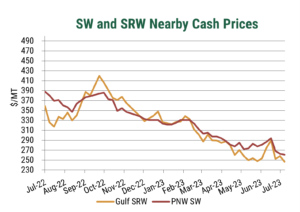

Moreover, SW prices have softened substantially over the past year, weighed down by recovered production in the 2022/23 crop year, decreased export demand, competition from other origins, and seasonal pressures as exporters more aggressively price SW into the global market. Over the last six months, SW prices have decreased from $321/MT in January 2023, to $263/MT in July 2023, their lowest level since November 2020. Furthermore, there has been little to no premium for max 9.5% protein versus max 10.5% protein throughout a majority of the 2022/23 crop year.

Source: USDA World Agricultural Supply and Demand Estimates

Looking Ahead

As of July 17, the USDA crop progress report put winter wheat in Washington, Oregon, and Idaho at 6%, 15%, and 5% harvested, respectively. With little harvest progress and no quality data collected, no definitive information is yet available regarding SW production yield, and quality characteristics. Keep in mind that anecdotal evidence generally indicates that dryland areas and regions with shallow soil are harvested first. Thus, higher protein is expected to be registered early in the season.

U.S. Wheat Associates recommends closely monitoring the SW harvest and maintaining regular communication with your supplier regarding protein availability and premiums. For weekly updates to harvest and price information subscribe to the U.S. Wheat Associates Harvest Report and Price Report.

Source: U.S. Wheat Associates Price Report