Over the last few weeks, we have analyzed several factors that are shifting or have the potential to shift U.S. wheat value toward wheat importers. A combination of lower futures prices, a break in dry bulk freight prices, an increase in planted area, and the potential for a weaker dollar all point to a wheat market that has turned to favor buyers after two years of price risk. Though it is the most unpredictable of all the factors influencing U.S. wheat prices, the weather is arguably the most critical component in determining U.S. wheat production and price.

El Niño Southern Oscillation

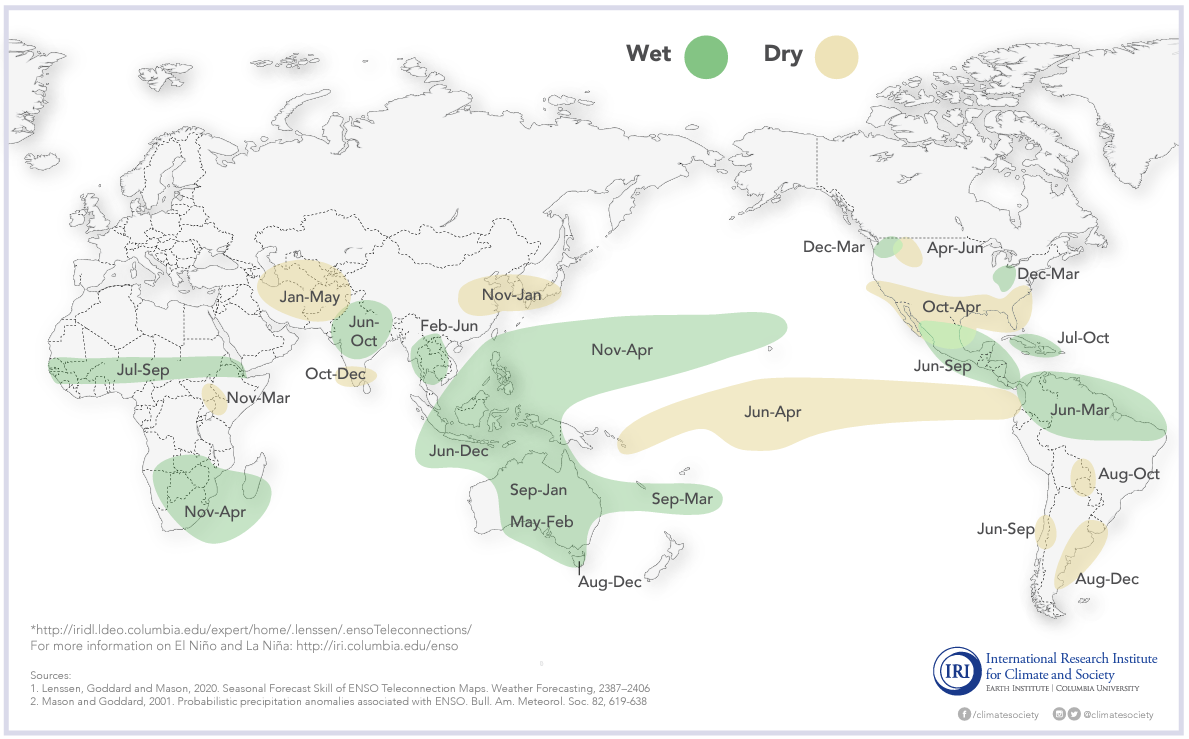

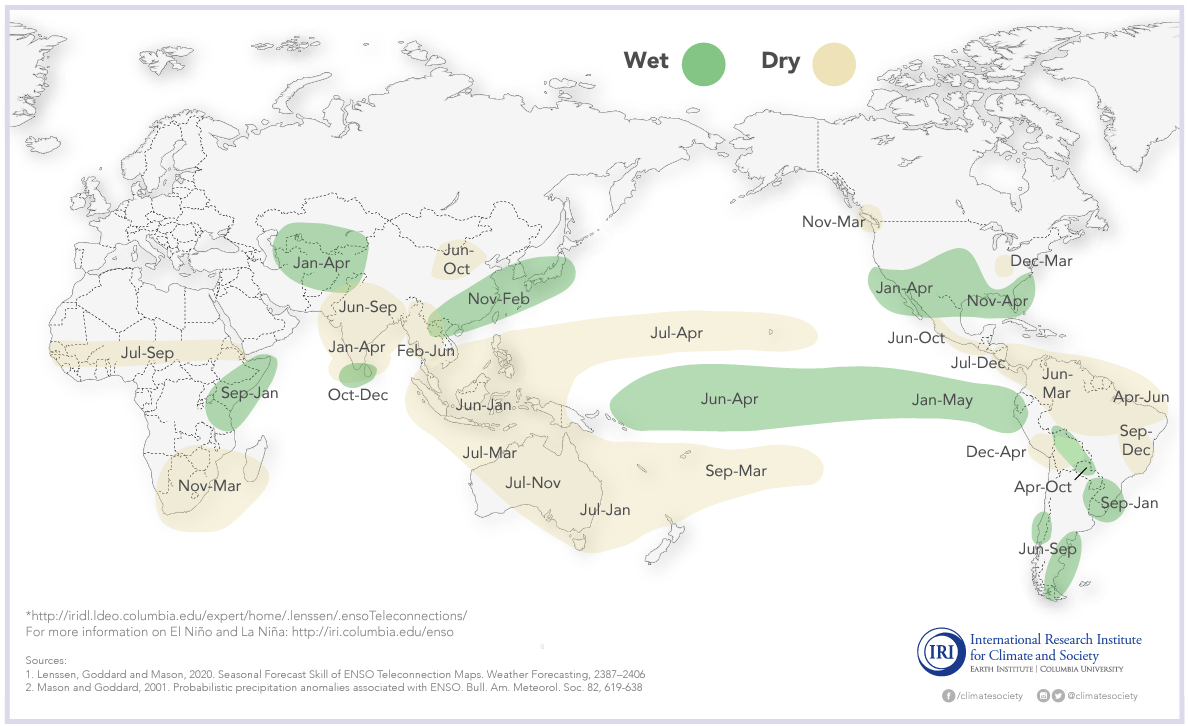

In a cycle called El Niño Southern Oscillation (ENSO), meteorologists study the air and water conditions in the equatorial Pacific and the subsequent impact on global weather patterns.

“Triple Dip” La Niña

Usually lasting nine to 12 months, the most recent La Niña event persisted for three cycles, marking the first “Triple Dip” La Niña since 2001.

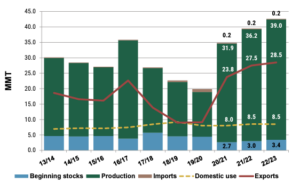

The three consecutive La Niña events have brought above normal rains to Australia during their wheat growing season. As a result, Australia has boasted three years of record wheat production. The average production from 2020-2023 is 66% higher than the previous five-year average.

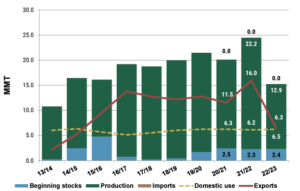

Simultaneously, the La Niña weather event brought dry conditions to the U.S. and Argentina. U.S. Hard Red Winter wheat (HRW) production, the largest class of U.S. wheat grown primarily in the U.S. Southern Plains, decreased by 29% on the year to 14.5 MMT due to severe drought in the region. Likewise, USDA estimates put Argentine wheat production at 12.9 MMT, down 41% from the year prior and 33% from the five-year average, with persistent drought also acting as the primary cause.

A Break in The Cycle

In recent weeks, climate experts have predicted the end of La Niña, with an increased likelihood of an El Niño weather event forming. As the La Niña dissipates, there is potential for increased moisture in the U.S. Southern Plains and Argentina, while Australia will likely see drier conditions.

What Does This Mean?

The market has already begun to weigh the impact of the shifting weather patterns. The Australian Bureau of Agricultural and Resource Economics and Statistics has already lowered 2023/24 wheat production estimates by 28% to 28.2 MMT in response to the new weather data.

As the weather changes and the potential for moisture increases in the U.S. Southern Plains, the production outlook in the U.S. may improve. Increased production would help take pressure off the tight U.S. balance sheet with the potential to bring down relatively high U.S. wheat export prices. Nevertheless, given the unpredictability of the weather, the actual impacts will not be known until well into the 2023/24 marketing year.

By USW Market Analyst Tyllor Ledford