On May 12, USDA released its initial estimates for the 2023/24 marketing year (MY) year, providing the first glimpse into how the world wheat situation has shifted in response to political instability, inflation, climate variability, and the volatility seen in the last year. This article will examine key takeaways from the World Agricultural Supply and Demand Estimates (WASDE) and the USDA Crop Production Report, and what it may mean for the 2023/24 crop year.

Global Outlook: A Focus on Weather

Despite recording record wheat production of 789.7 MMT, up 1.5 MMT from 2022/23, world wheat supplies have tightened. Consumption surpasses production by 2.0 MMT for the fourth consecutive year, leading to a decline in global ending stocks. Projections indicate the lowest global ending stocks in eight years at 264.3 MMT. Ending stocks in the five non-Black Sea exporting countries (U.S., Canada, Australia, Argentina, and the EU) have hit their lowest level since 2007/08 at 38.2 MMT.

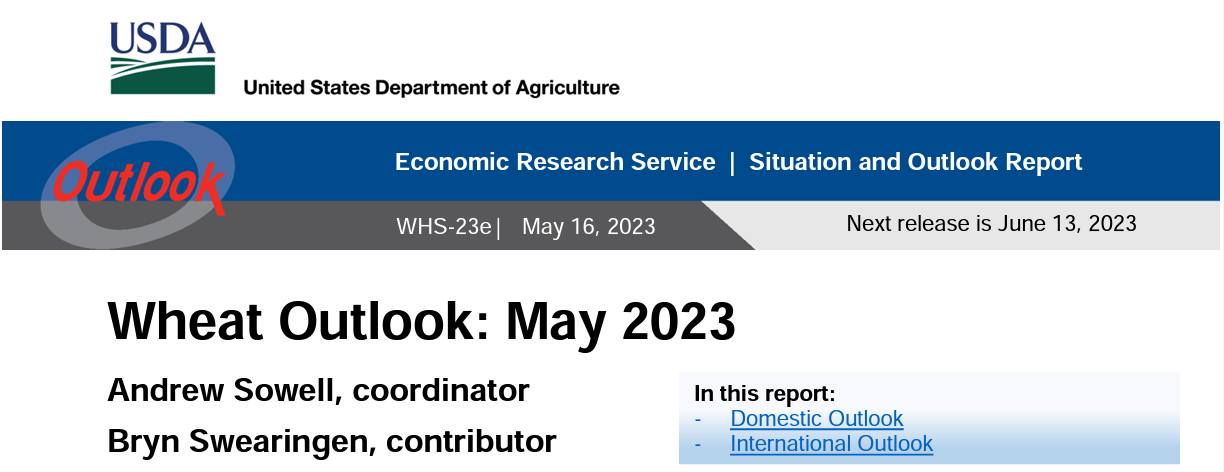

Production in major exporting countries is also forecast to be down 10.0 MMT to 367.6 MMT from a record 377.5 MMT in 2022/23. Production is predicted to increase in Argentina (+7.0 MMT), Canada (+3.2 MMT), and the EU (+4.7 MMT). However, these increases do not offset flat production in the U.S. (+0.3MMT) and reductions for Ukraine (-4.4 MMT), Russia (-10.5 MMT), and Australia (-10.0 MMT).

Weather poses risks to many production regions, including anticipated dryness in Australia associated with an El Niño weather event and reports of dryness in Canada. USDA predicts improved production in Argentina that hinges on recovery from the 2022/23 drought there. With ending stocks already hovering at 15-year lows, any change in production in major exporting countries could have a direct influence on world wheat prices.

U.S. Situation- Bullish Supply Meets Bearish Demand

Much like production in other major exporting countries, the weather has driven the U.S. wheat harvest conversation. As the drought in the U.S. Southern Plains persists, the May 12 USDA crop production figures put Kansas HRW production at 14.0 MMT, the lowest output since 1957/58. Similarly, USDA projections put Kansas (the largest HRW-producing state) wheat production at 181.0 million bushels. The annual Wheat Quality Council (WQC) winter wheat tour confirmed this outlook.

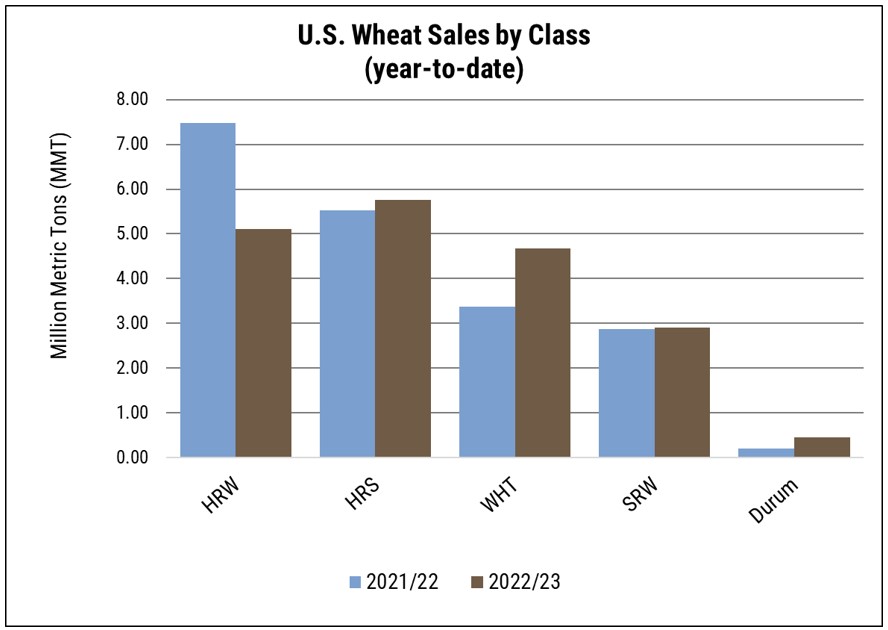

Despite the bullish outlook from the May Crop Production report and the subsequent futures rally, HRW futures prices declined, losing 73 cents in the week ending May 22. Likewise, hard red spring (HRS) and soft red winter (SRW) also softened, down 64 and 55 cents respectively from last week. A key factor contributing to this bearish trend is demand rationing in the face of high prices and seasonal pressures.

Bright Spots

Despite the complexity of the HRW situation, the outlook for other U.S. wheat classes, especially soft wheat classes, remains optimistic. The Crop Production Report put SRW estimates at 11.0 MMT, a 21% increase from 2022/23, and prices for SW and SRW continue to trend lower to remain competitive with other origins. Likewise, as of the May 21 Crop Progress Report, the winter wheat conditions have begun to see improvement, with a season-high of 31% ranking good to excellent. Spring wheat farmers have also made tremendous planting progress, with a 24% increase in plantings over the week, reaching 64% planted, only 9% behind the five-year average, alleviating concerns about late planting.

A More Detailed Look to Come

In the coming weeks I will recap the 2022/23 U.S. wheat export trends and highlight what to watch as new crop sales increase. In June, USDA will begin revising its initial estimates for the 2023/24 world supply and demand and the July WASDE will provide the first by-class wheat projections for the 2023/24 crop year.