World durum supplies were tight early in marketing year 2023/24 as drought in the Middle East and Canada and quality issues in the European Union (EU) decreased durum availability and put upward pressure on global durum prices. However, as the marketing year continued, non-traditional durum exports from Russia and Türkiye began flooding markets with low-priced durum, weighing on global durum values.

The following will evaluate the current world durum situation and provide an initial outlook for marketing year 2024/25.

Tight Situation in Major Exporters and Importers

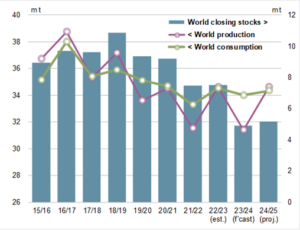

International Grains Council (IGC) data indicated that global durum production decreased by 10% to 31.4 million metric tons (MMT) in 2023/24, and consumption exceeded production by 2.6 MMT, leading to a tight durum balance sheet. In Canada, the world’s largest exporter, durum production fell 30% to 4.0 MMT due to drought in the primary growing areas, as reported in the Canadian Outlook for Principal Field Crops. In the EU, a drought in Spain reduced output, resulting in total EU production of 7.0 MMT, 7% below the previous year, according to IGC. Simultaneously, harvest rains in Italy compromised durum crop quality. As a result, EU durum imports rose by 26% to 3.4 MMT.

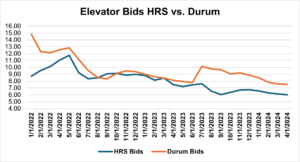

The combined impact of decreased durum availability and the increased import requirements supported world durum prices throughout the final quarter of calendar 2023 and into the early months of 2024. In October 2023, French durum prices hovered at $428/MT, U.S. durum (photo above) at $467/MT, and Canadian durum at $450/MT, as reported by IGC, U.S. Wheat Associates, and AgriCensus.

Rise of Non-Traditional Exporters

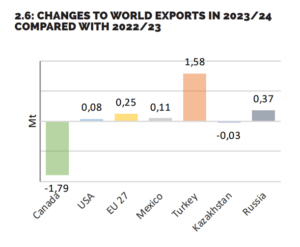

As major exporters’ balance sheets remained tight, Türkiye shifted from a net durum importer to a major exporter. Turkish durum production rose by 15% to a record 4.3 MMT in 2023/24, on a higher planted area and sufficient growing season moisture.

The combination of favorable prices, above-average production, and export focused domestic support programs prompted the Turkish Grain Board (TMO) to authorize the sale of 150,000 MT of durum on February 1, 2024, at prices quoted below market values. On March 7, TMO offered an additional 150,000 MT of durum but canceled the offer as the quoted prices were too low relative to domestic price levels. Nevertheless, Turkish durum exports were estimated at 1.7 MMT for the year as prices remain ultra-competitive relative to other origins. Meanwhile, Stratégie Grains forecasted Russian durum production at 1.3 MMT, with exports projected at 800,000 MT, a 60% increase on the year.

The influx of low-priced Turkish and Russian durum has eroded world durum prices. As of April 16, French durum prices sit at $375/MT, U.S. near $351/MT, and Canadian at $360/MT, down $53, $116, and $90 from October’s prices, respectively.

Will The Patterns Hold?

IGC forecasts a recovery in world durum production in 2024/25 to 34.6 MMT on favorable weather in Canada, EU, and Türkiye. Current estimates suggest Turkish durum production will remain strong in 2024/25 at 4.5 MMT, while exports may exceed 1.0 MMT. It is unknown if Türkiye will rise as a long-term durum exporter, but balance sheets are comfortable in the immediate future.

Nevertheless, in the current lower-priced market, U.S. durum remains competitive. U.S. durum exports are up 36% on the year at 504,000 MT on increased imports from Algeria. Moreover, the 2024/25 durum area is forecast to increase by 300,000 acres (121,400 hectares) to surpass 2.0 million acres (809,400 hectares) for the first time since 2018/19. Favorable prices for durum relative to hard red spring (HRS) wheat may incentivize producers to substitute durum acres for HRS, particularly in non-traditional durum growing areas. As of April 16, the average country elevator bid for durum sits at $7.51/bu, a significant spread compared to $6.07/bu for HRS.

The U.S. has and always will be a stable producer and exporter of durum. As world markets shift and adjust, the U.S. has remained a constant supplier, providing reliable, high-quality supplies of durum and other wheat classes on which customers worldwide can rely.

By USW Market Analyst Tyllor Ledford