By Stephanie Bryant-Erdmann, USW Market Analyst

There is an old saying: “When there’s blood on the streets, buy property.” Given recent price movements, that could easily be changed to: “When trade policies are in the news, buy wheat.”

Since the steel and aluminum tariffs went into full effect for major U.S. wheat customers, September Kansas City hard red winter (HRW) wheat futures have fallen 51 cents per bushel ($19 per metric ton [MT]), September Chicago soft red winter (SRW) wheat futures dropped 25 cents per bushel ($9 per MT) and Minneapolis hard red spring (HRS) plunged 58 cents per bushel ($21 per MT).

Seasonal harvest pressure always impacts U.S. wheat prices during the summer months; however, this year the unique trade environment is also pressuring export demand and driving U.S. wheat prices lower. As of July 19, U.S. export sales for marketing year 2018/19 (June 1 to May 31) totaled 6.43 MMT, down 32 percent year over year. Exporters note that customers are choosing to purchase smaller than normal volumes of U.S. wheat, just what they need for the short-term or are waiting to make purchases, noting uncertainty about U.S. trade policies and their own countries’ retaliatory measures. Sales to the top five U.S. wheat customers — Mexico, Japan, the Philippines, Korea and Nigeria — are 27 percent behind last year’s pace.

With trade policy issues dominating the headlines, U.S. wheat futures markets are mostly ignoring global wheat supply and demand fundamentals, which can be seen in competitors’ wheat prices. The average global wheat price is up 41 cents per bushel ($15 per MT) with larger increases noted in Australia and Argentina, which compete with the United States in key quality-driven markets. According to International Grains Council (IGC) data, the average price of Australian wheat is up $19 per MT and the average price of Argentine wheat is up $75 per MT. These price increases are driven by increased global wheat demand, shrinking global wheat supplies and their location.

USDA noted in last week’s World Agricultural Supply and Demand estimates that global wheat production will fall to 737 MMT in 2018/19, the first drop in 5 years and down 3 percent from 2017/18. Decreased production is expected in the European Union (EU), Russia, Ukraine, Kazakhstan, and Australia. While the United States, Canada and Argentina are expected to have increased production, exporter supplies are expected to fall 20.2 MMT year over year.

Simultaneously, many importers are engaging in “just in time” purchases since wheat price movement has rewarded their patience the last few years. USDA expects importer ending stocks to fall to 49.8 MMT in 2018/19, the lowest amount in a decade.

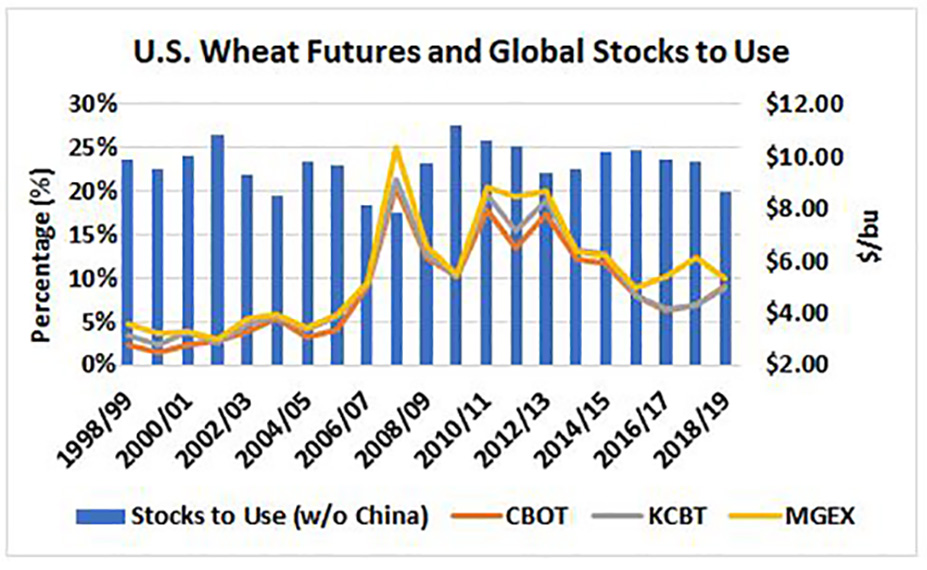

While importer stocks are shrinking, USDA expects global wheat demand to surge to a new record high of 749 MMT, 4 percent above the 5-year average. That means that global wheat consumption will outpace global wheat production by 12.6 MMT this year and drop the global wheat stocks-to-use ratio (excluding China) to less than 20 percent. A level that has not been seen since 2007/08.

For perspective, in July 2007 all three wheat futures were above $6.00 per bushel ($220 per MT) and would continue climbing until March 2008 when prices peaked at $11.60 per bushel ($426 per MT) for SRW, $12.17 per bushel ($447 per MT) for HRW and $17.30 per bushel ($636 per MT) for HRS. On Friday, July 20, those three futures were at $5.16 per bushel ($190 per MT), $5.08 per bushel ($187 per MT) and $5.55 per bushel ($204 per MT), respectively, indicating there is a lot of room for upward mobility.

With exporter supplies shrinking and importers continuing a “just in time” purchasing pattern, global wheat prices are sitting on a powder keg that trade policy issues are currently disguising. Customers should take advantage of current U.S. futures price levels and lock in the competitive prices.

To track U.S. wheat export prices, subscribe to the USW Weekly Price Report.