USDA’s National Agricultural Statistics Service (NASS) will publish its first official estimate of U.S. winter wheat planted area for the 2023/24 crop on Jan. 12, 2023. Along with U.S. wheat importing customers, U.S. Wheat Associates (USW) will be watching trade estimates before the report is issued and make some comparisons to NASS estimates in 2022.

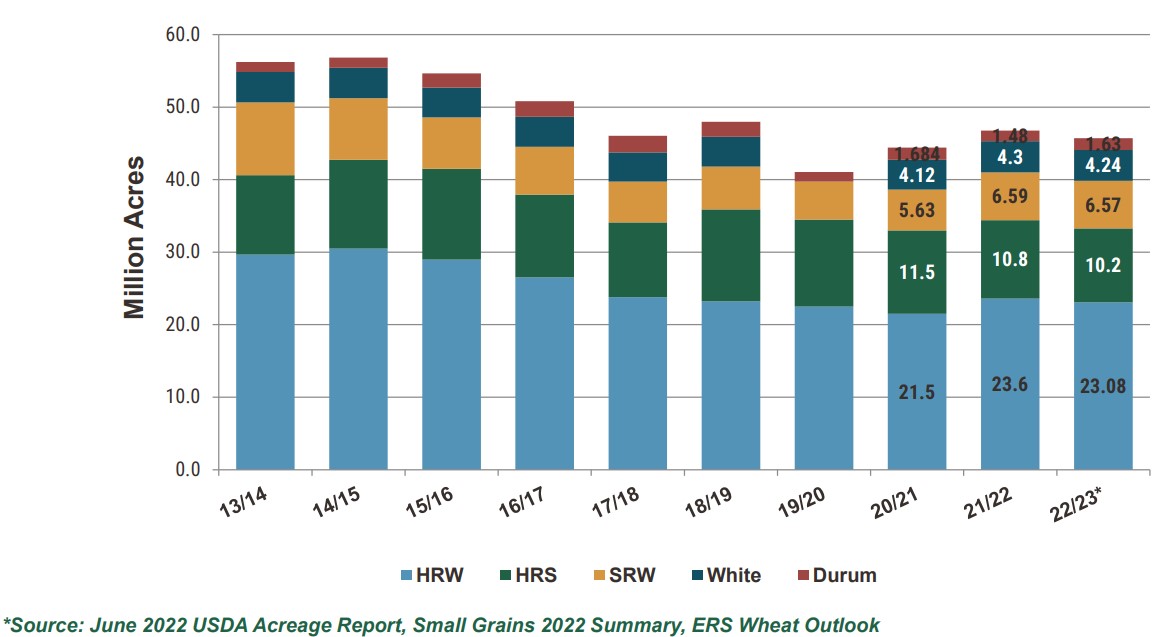

USDA’s Economic Research Service has noted that “the general downward trend in U.S. wheat plantings over the last two decades is attributable to lower relative returns for wheat, changes in Government programs that give farmers more planting flexibility, and increased competition in global wheat markets.”

The past three marketing years, however, have seen a slight change in that trend.

At planting time in 2022, the relatively high farm gate prices for hard red winter (HRW), soft red winter (SRW) and white winter wheat (including winter soft white and hard white) provided some incentive to plant more winter wheat. Looking ahead, the pre-report predictions to date for total winter wheat planted area of between 34 million acres (MA) and 36 MA are both higher than the final 2022 crop NASS estimate of 33.27 MA. A survey of traders by Bloomberg posted Jan. 9 estimated total winter wheat planted area at 34.5 MA.

More Planted Acres Expected

Wheat analyst Jeffery McPike with WASEDA Commodities and McWheat Trading Inc., recently pegged that group’s initial 2023 planted area forecast at 35.7 MA that, if realized, would be a 7.3% increase over NASS’s final 2022 estimate. The high end of estimates in Bloomberg’s survey is 36.2 MA.

The group’s forecast of 24.8 MA for HRW planted area is 7% more than the final NASS 2022 estimate based mainly on expected gains in the Central and Southern Plains. The Bloomberg trader survey estimate averaged 23.9 MA.

McPike said the group is bullish on SRW planted area with a forecast of 7.22 MA, which is 11% more than NASS’ final 2022 estimate. For example, an Arkansas Extension official recently reported that “good prices and a relatively dry fall likely encouraged farmers to plant more winter wheat for a 2023 harvest. Early estimates are that winter wheat acres in Arkansas will be up 25% to 30% from last year.” Traders surveyed by Bloomberg estimate the average at 6.9 MA.

The group sees only a slight uptick in white winter wheat planted area to 3.65 MA. The Bloomberg trader estimate average was 3.7 MA. The January 2022 NASS estimate for winter white planted area was 3.56 MA.

And Watch Harvested Area and Production Estimates

NASS will adjust its winter wheat planted area forecast throughout 2023. And, as McPike pointed out, the currently unknown harvested area, along with production estimates, will be major price determinants. For example, compare the final 2022 NASS estimate of HRW planted area of 33.89 MA to final harvested area of 24.05 MA.

“After the NASS figure is published and gets digested, the market will likely quickly move to winterkill issues (again) in the U.S., Europe, and the Black Sea regions,” McPike said, “and harvested area discussions, along with the many macro issues that continue to roil the markets.”

The annual NASS Winter Wheat Seedings report will be published here: https://usda.library.cornell.edu/concern/publications/z890rt24s,

An additional source of information is the USDA Economic Research Service December 2022 Wheat Outlook published at https://downloads.usda.library.cornell.edu/usda-esmis/files/cz30ps64c/hh63v4630/zc77v192n/WHS-22l.pdf.