Mexico, Central America, the Caribbean, and South America represent a substantial portion of U.S. wheat sales, accounting for around 33% of all U.S. wheat exports. Due to proximity and sophisticated, quality-focused markets, Latin America and the Caribbean see competitive advantages in U.S. wheat supplies. In fact, while total demand for U.S. wheat slowed the last two years, sales to Latin American countries increased.

This trend signifies the value of U.S. wheat to customers throughout the region. This article will analyze the recent trends in Latin American markets and highlight current opportunities for U.S. wheat importers based on their patterns.

Looking Back

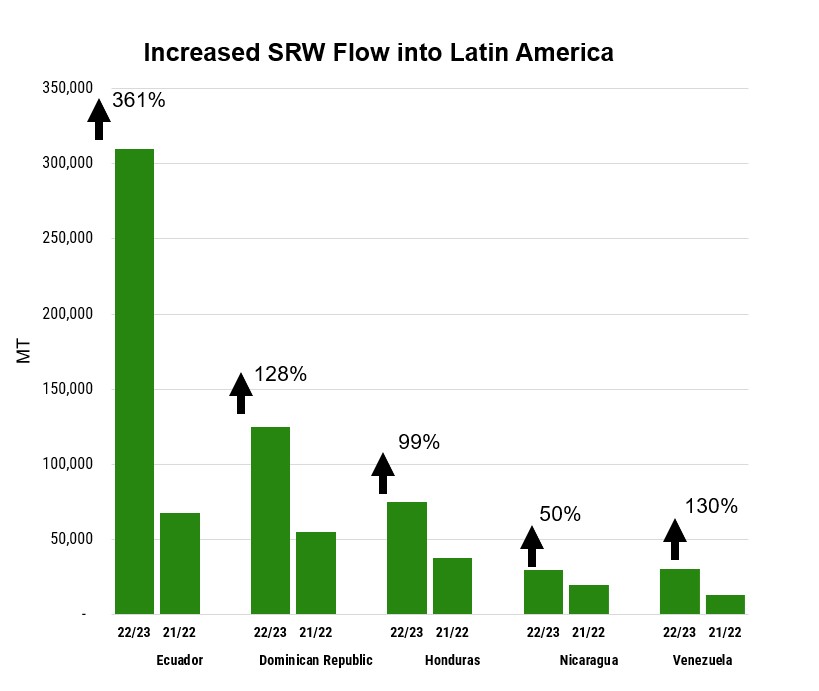

In the marketing year (MY) 2022/23, South American wheat imports were 1.6 MMT, up 29% from MY 2021/22, while U.S. wheat exports decreased by 2% from the prior year and were 17% below the five-year average. On a country level, significant sales increases were observed in Chile, Ecuador, and Brazil, among others.

Despite high prices, customers in Latin America and the Caribbean continued seeing the value in U.S. wheat classes, particularly soft red winter wheat (SRW). SRW sales were up 28% from the year prior and 31% above the five-year average regionwide.

Emphasis On Value

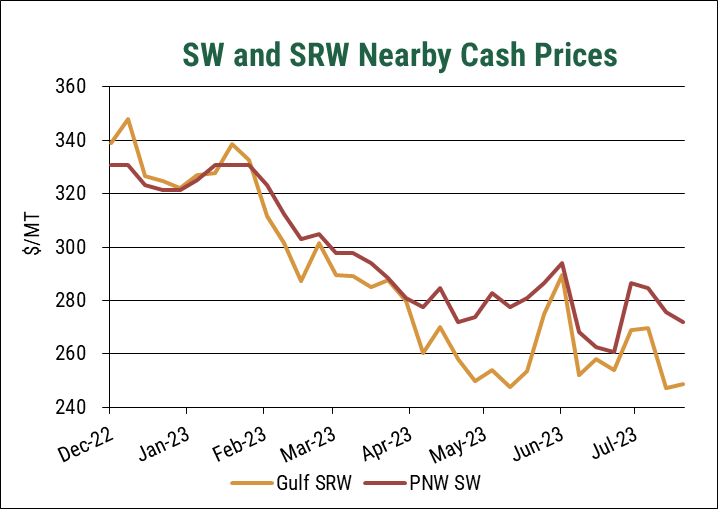

Moving into MY 2023/24, SRW remains an excellent value. The latest U.S. Wheat Associates (USW) Price Report put U.S. SRW at $249/MT FOB, competitively priced with other origins. Despite the recent volatility in wheat markets, SRW prices remain at their lowest level since the summer of 2021, and wheat futures have just breached the $6.00/bu threshold.

Sales of SRW are tracking above last year’s pace. The most recent commercial sales put SRW commitments at 1.6 MMT, and the majority of this increase can be attributed to purchases from Latin American and Caribbean customers. In South America, SRW purchases are up 37%, while total U.S. wheat sales are down 34% in the region.

The August World Agricultural Supply and Demand Estimates put SRW exports at 3.7 MMT, up 26% from the year prior and up 37% from the five-year average.

Risk Management is Vital

As mentioned in previous articles, the war in the Black Sea is a continued risk in the world wheat market. Though risk premiums have been eroded and the market appears to have reached some level of “comfort” with the war, prices can spike in an instant, especially as fighting has intensified in the weeks since the dissolution of the Black Sea Grain Agreement.

As seen in commercial sales to many Latin American customers, SRW demonstrates an excellent value as a high-quality and competitively priced soft wheat. Nevertheless, with the potential for more upside risk than a downward opportunity for SRW and all U.S. wheat classes, importers must watch market conditions closely to maximize SRW’s value in their blends. Your local USW office will be an important partner in this effort.

By Tyllor Ledford, USW Market Analyst