As the Northern Hemisphere harvest concludes and crops in the Southern Hemisphere near maturation, wheat markets are still highly sensitive to weather-related news. As headlines about dry conditions around the globe come and go, and markets fluctuate daily, having information about the current drought conditions worldwide and potential impacts remains important to wheat buyers.

Southern Hemisphere

At this stage in the Southern Hemisphere, weather conditions become crucial for determining yield potential.

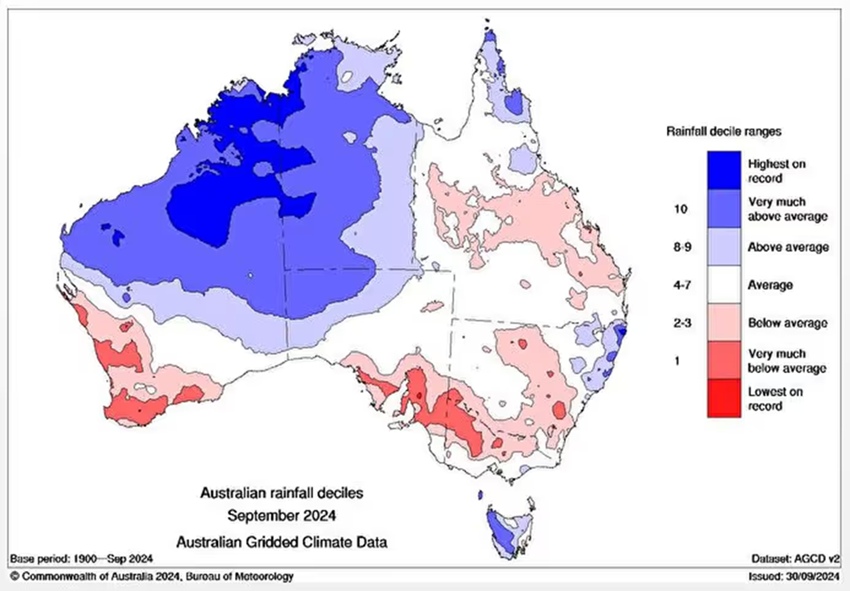

In September, persistent dryness in Western Australia prompted the state’s grain industry association to reduce the region’s output by 7% to 9.3 million metric tons (MMT), while late-season frost had detrimental effects across southeast Australia. In response, private analysts lowered their total Australian production estimates to between 27 MMT and 29 MMT. Despite the decrease, current projections still align with the five-year average of 29.8 MMT. Likewise, estimates from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) and the October World Agricultual Supply and Demand Estimates (WASDE) held their forecasts steady at 31.9 MMT and 32 MMT, respectively.

Similarly, in Argentina, a recent update from the Rosario Grains Exchange decreased Argentinian wheat production 1.0 MMT to 19.5 MMT, as key farming areas remain dry. Even so, the October WASDE kept Argentinian production at 18 MMT, a 2.2 MMT bump from the year prior and a 42% increase from the 2022/23 drought.

Northern Hemisphere

In the Northern Hemisphere, harvest is complete and the 2024 crop is in the bin. However, recent dry conditions in Russia and the United States, along with a recent history of drought conditions, have begun to raise some concerns about potential planted area.

Following the drought in 2024/25 that cut Russian wheat production by 10% to 82.0 MMT, dryness lingers. SovEcon reported that poor weather in key growing regions has reduced Russian winter grains planting to 8.3 million hectares (20.5 million acres), down from 9.3 million hectares (22.9 million acres) last year, marking the lowest level since 2013. This reduction in planted area could negatively affect the 2025/26 harvest; however, it is too early to make definitive assessments. Furthermore, a forecast for rain may provide short-term relief across Russia.

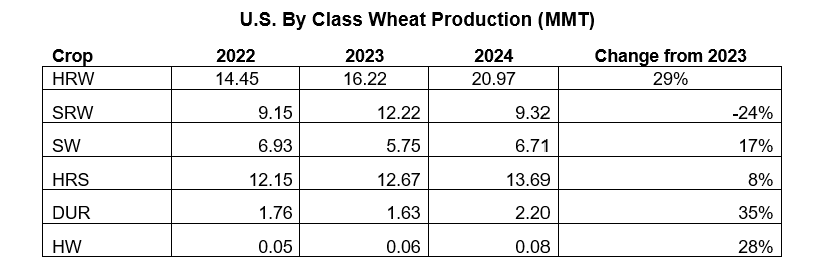

Turning to the domestic front, dry conditions have dominated discussions; however, U.S. conditions remain much improved compared to the devastating drought from 2021 to 2023. As expected, the USDA Small Grains Summary put final 2024/25 U.S. wheat production at 53.6 MMT, a 9% increase year over year, on improved growing conditions. For all classes, yields sit at 51.2 bu/acre, the highest level since 2019, while hard red spring (HRS) yields came in at 52.5 bu/acre, the highest on record.

Planting Progress

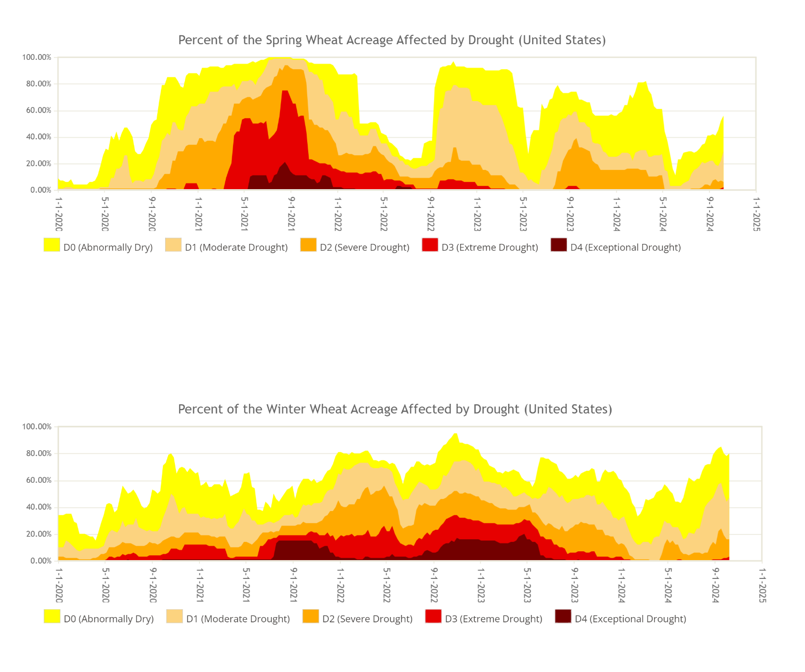

Looking ahead, planting progress is on track with 64% of the crop planted; however, additional moisture will be necessary to promote emergence before dormancy. According to the USDA Drought Monitor, 47% of winter wheat regions are currently experiencing drought, a decrease from 49% last year and a substantial drop from the peak of 66% in 2022. Similarly, only 29% of spring wheat is in drought-affected areas, down from 51% last year and significantly lower than the peak of 98% in October 2021.

Despite the significant media coverage of drought and dryness, long-term effects have not yet been observed in current data. Production in Australia and Argentina remains steady and in line with long-term averages, while more insights are expected once harvest campaigns begin. Likewise, it is premature to draw any conclusions about the newly planted 2025/26 winter wheat crop. As farmers know all too well, only Mother Nature has the power to alter the narrative.

See the latest detailed World Supply and Demand information from U.S. Wheat Associates (USW) here.

By USW Market Analyst Tyllor Ledford