By Michael Anderson, USW Market Analyst

U.S. Wheat Associates (USW) represents the interests of wheat farmers in export markets. Each time the USW Board of Directors meet, we report on the latest market information that affects the U.S. wheat marketing environment. At their meeting the week of Jan. 10, 2022, our directors will see continued fundamental support for wheat prices from greater demand worldwide and lower production in major exporting countries.

The next USDA World Agriculture Supply and Demand Report will be released on Jan. 12. Ahead of that report, USDA pegs 2021/22 world wheat production at a record 777.89 million metric tons (MMT), 3% above the 5-year average of 757.4 MMT. Total global supplies are forecast to reach 1,068 MMT, slightly lower than last year. USDA noted lower wheat production in Canada, Russia, and the United States, which all experienced drought in the 2021 growing season.

USDA expects wheat production to be higher in Ukraine, the European Union (EU), Australia and Argentina. Specifically, in Ukraine, production is forecast up 30% this year due to increased planting and favorable weather conditions. In Australia, production is up 700,000 MT to 34 MMT. Argentina may also produce a record wheat crop this year. The Buenos Aires Grains Exchange (BAGE) estimates wheat production at 21 MMT, 1 MMT more than USDA’s December production estimate. USDA estimates 2021/22 world wheat ending stocks will drop 2% from the 5-year average and be 278 MMT, a 12 MMT drop compared to last year and the lowest level since 2016/17.

Global Consumption Outpaces Production

Fundamental support for wheat prices is also seen in global consumption that is expected to increase 7 MMT to 789 MMT, up 1% compared to 2020/21. Both global human wheat consumption and feed wheat use are forecast higher. Feed wheat use is expected to increase 2% to 161 MMT. Lower beginning stocks, drops in production for major exporters, and increased use have supported higher wheat prices overall. In the USDA’s December supply and demand report, the estimated average farm gate price for U.S. wheat is $7.05/bu, a 54% increase year-over-year.

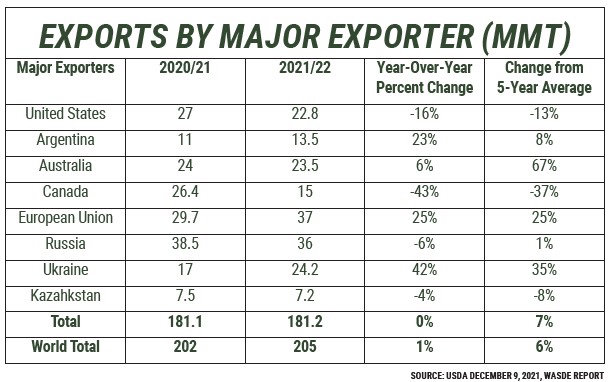

USDA expects global wheat trade to reach 205 MMT, up 1% from last year and 6% more than the 5-year average.

Price Effect on Export Sales

Through Dec. 23, 2021, total U.S. wheat export sales of 15.8 MMT are 23% behind last year’s pace according to USDA commercial export sales data. Soft red winter (SRW) sales are significantly ahead of last year’s pace. USDA projects total 2021/22 exports will hit 22.8 MMT which, if realized, would be 16% less than last year and 13% less than the 5-year average.

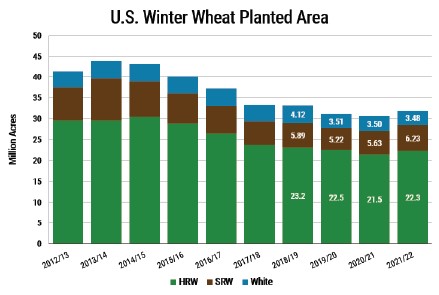

One year ago, USDA saw winter wheat seeded area was up 5% from 2020 at 32 million acres. USDA’s annual Small Grains Summary, released in September 2021, had U.S. wheat production at 1.65 billion bushels, down 10% from 2020 despite harvested area being up 1% at 37.2 million acres. Winter wheat production was up 9% but spring wheat production was down 44%, soft white production (both winter and spring) was down 16% and durum wheat production was down 46%.

USDA assessed that winter wheat production was 1.28 billion bushels, up 1.1 million bushels with an average yield of 50.2 bu/acre, down 0.7% compared to 2020. The area harvested for winter wheat was 25.5 million acres, up 11% compared to 2020. Hard red winter (HRW) harvested acres were up 10% and production totaled 749 million bushels, 14% more than in 2020. Soft red winter (SRW) production totaled 361 million bushels, up 35% compared to 2020. Spring wheat production was estimated at 331 million bushels, down 44% from 2020. The harvested area totaled 10.2 million acres, down 16% from 2020 with an estimated yield of 48.6 bu/acre. Hard red spring (HRS) accounted for 297 million bushels, down 44% from 2020.

Start 2022 With USW Market Information Reports

USW monitors USDA’s assessments of the fundamentals supporting wheat prices each month in our Global Wheat Supply and Demand Report. In addition to the January WASDE report, USDA’s Winter Wheat Seeding Report will also be released Jan. 12. Export prices are updated weekly. Visit the Market Information page on our website or subscribe to USW market reports here.