Supply, Quality and Price Support USDA Wheat Export Estimates

By USW Market Analyst Claire Hutchins

Between January and February 2020, USDA raised its total U.S. wheat export estimate from 26.5 million metric tons (MMT) to 27.2 MMT, 7% greater than last year, if realized. U.S. Wheat Associates (USW) believes the United States is on track to reach USDA’s export estimates due to favorable marketing trends in the first half of 2019/20 that led to a strong export pace between June 2019 and February 2020.

U.S. wheat farmers continue to produce an abundant supply of high-quality wheat, which is always a factor in overseas demand. Export prices have certainly attracted customers’ attention in marketing year 2019/20. And if they compare current price trends to what has happened at this time of year on average the past five years, customers can also see an unusual buying opportunity.

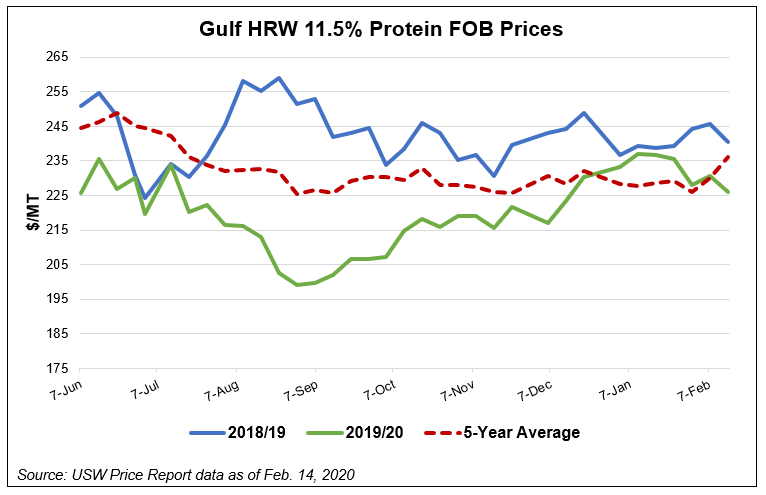

HRW. USDA expects 2019/20 HRW exports will reach 10.6 MMT, 18 percent greater than last year, if realized. Relatively low HRW prices during the first half of 2019/20 boosted HRW exports into early 2020. Between early June 2019 and late December 2020, the average Gulf HRW 11.5% protein (on a 12% moisture basis) FOB price trended about 7 percent below the 5-year average price. As of Feb 13. 2020, HRW exports to all destinations total 6.44 MMT, 33 percent greater than this time last year and 61 percent of USDA’s 2019/20 forecast. HRW prices climbed between late August and early January but have fallen back 4 percent between to $226/MT FOB, offering a price incentive for the final months of the marketing year.

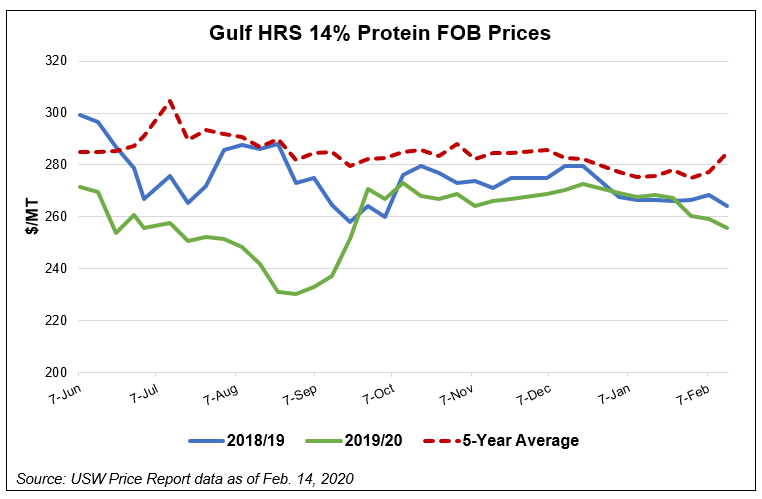

HRS. USDA forecasts 2019/20 HRS exports will reach 7.48 MMT, 6 percent greater than last year, if realized. As of Feb 13. 2020, HRS exports to all destinations total 4.62 MMT, slightly below last year and 62 percent of USDA’s 2019/20 forecast. Gulf HRS 14% protein prices trended dramatically below 2018 values and the 5-year average price between early June and late September, until concerns of a wet harvest brought prices more in line with 2018 levels at about $270/MT. However, HRS prices are trending down in the second half of 2019/20 and are, on average, 5 percent lower than the 5-year average FOB trendline at about $264/MT. Industry experts believe HRS FOB prices could continue their downward trend on cheaper nearby secondary rail rates and light export demand, beneficial for deliveries in April and May 2020.

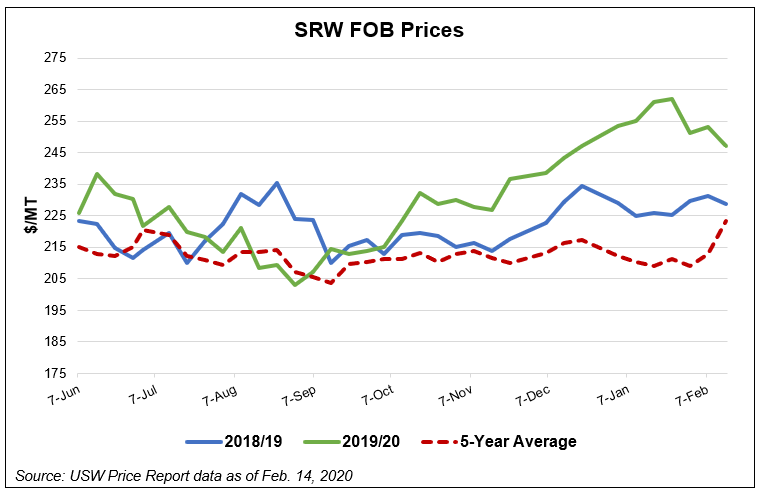

SRW. USDA predicts SRW exports will total 2.72 MMT, 22 percent lower than last year, if realized. USW reported Feb. 5, soft red winter (SRW) export prices had been climbing steadily since the end of the 2019 harvest on reduced production, tight ending stocks and stable domestic and overseas demand. However, after Jan. 24, a dip in export demand pressured prices, offering an opportunity for SRW importers to lock in a lower price through the end of marketing year 2019/20. Between Jan. 24 and Feb.14, 2020, SRW prices fell 6 percent to $247/MT FOB. Despite reduced production and higher than average prices, SRW exports to date are in line with this time last year at 1.83 MMT, 67 percent of USDA’s final forecast.

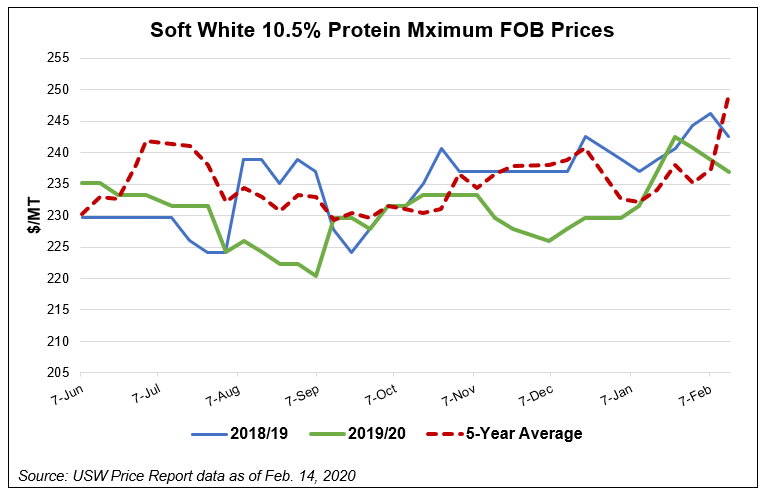

White wheat (soft and hard). USDA predicts 2019/20 white wheat exports will total 5.31 MMT, in line with last year and 15 percent greater than the 5-year average of 4.60 MMT. For the majority of the first half of 2019/20, soft white (SW) wheat (representing 99 percent of U.S. white wheat production) 10.5% maximum protein prices trended well below the last year’s price and the 5-year average price over the same time period, providing overseas customers with ideal white wheat buying opportunities. As of Feb. 14, the SW 10.5% protein maximum FOB price was $237/MT, 2 percent lower than this time last year and 5 percent below the 5-year average. As of Feb. 13, 2020, all white wheat exports total 3.56 MMT, 3 percent greater than last year and 67 percent of USDA’s final white wheat export forecast.

Durum. USDA predicts 2019/20 U.S. durum exports will total 1.10 MMT, 83 percent greater than last year and 54 percent greater than the 5-year average. Durum exports to Italy, the largest market for U.S. durum, are more than double what they were this time last year at 439,000 metric tons (MT) due to a 12 percent reduction in European Union (EU) durum production in 2019. Year-to-date U.S. durum exports now total 655,000 MT, nearly double last year’s export pace and 60 percent of USDA total 2019/20 durum export forecast.