Reprinted with Permission from “Agweek,” August 2, 2017

[Editor’s Note: The original source for this article is the North Dakota Wheat Commission.]

The annual Wheat Quality Council (WQC) tour of the spring and durum wheat region took place the week of July 24, with the final yield result sparking questions and sharp criticism, especially in social media circles. The North Dakota Wheat Commission (NDWC) would like to acknowledge these concerns from producers, assess the crop tour yield estimate, and clarify some misinformation.

The wheat tour is organized by the WQC, based in Kansas City, not the NDWC. The tours are just a small part of the overall mission of the Council. Its primary focus is being a collaboration point and organization to test and evaluate new wheat varieties for end-use quality, and to ensure U.S. wheat production is meeting the quality needs of the wheat industry. It also serves to expand communication and education between wheat producers, wheat breeders, millers, bakers and other end-users.

The tour calculated an average yield of 38.1 bushels per acre for hard red spring wheat. While this is the lowest yield in about ten years for the tour, it was higher than expected by many producers, considering the severe drought conditions gripping nearly all western North Dakota. The NDWC agrees that this overall yield was higher than we anticipated based on weekly crop ratings and producer reports, and the WQC average yield needs to be looked at in its full context.

Why was the tour estimate higher than expected? Most routes covered central and eastern parts of the state, and higher yielding areas of Minnesota, with a lower than normal percent of field counts in western areas. This was not done intentionally; the tour has never taken routes into the far west portion of the state or into eastern Montana (also in severe drought). In more normal years when crop conditions are more balanced across the region, this has not been as big of an issue. However, in a drought year like this with high abandonment, it led to a lower than normal percent of field counts from western areas. The yield estimates given at the end of each day and at the end of the tour are simple averages. They are not weighted by production and there are no county yield estimates released. For durum, the average yield came in at 39.7 bushels per acre, which is well above the July USDA estimate of 27 bushels per acre for North Dakota. The tour routes did not cover the main durum producing counties in the state, which are facing the most intense drought conditions.

Accounting for abandoned acres is difficult, since yield reports are based on actual acres harvested for grain, not planted acres. It is well known that large portions of the crop are being abandoned due to the drought conditions in western growing regions, including South Dakota and Montana. Participants on the tour noted that on some routes, anywhere from 30 to 50 percent of the fields had been abandoned.

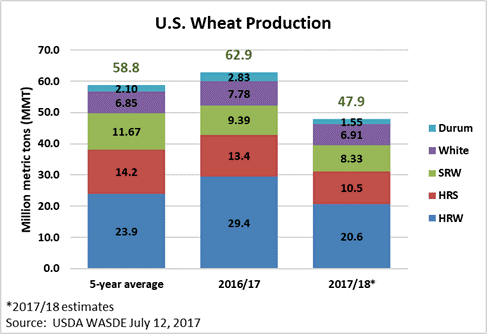

These abandoned acres will certainly have a significant impact on final production for both hard red spring and durum, but may not be fully reconciled until USDA releases its final harvested acreage report for the 2017 crops. Normal abandonment rates in the spring wheat region are 2 to 3 percent. The eastern acres will likely see normal abandonment, but portions of the western drought areas could be as high a 40 percent. In 2002, North Dakota abandoned 13 percent of its wheat plantings, and the rate was 23 percent in the 1988 drought. The question of abandonment is a concern in the market and once fully understood, it will have a big impact on final production; it is something buyers, producers and all involved in the wheat industry will need to focus on.

USDA’s July production report projected an average spring wheat yield of 38 bushels for North Dakota, 61 bushels for Minnesota, 26 for Montana, and 34 for South Dakota. All the USDA data is based directly on producer surveys with no objective yield surveys taken in fields. The upcoming August and September USDA estimates will follow the same pattern for yield, but it is uncertain when major adjustments for abandoned acres will be included. In its July estimate, USDA pegged planted acres of spring wheat in Montana, South Dakota and North Dakota at 8.55 million, and harvested at 8.22 million, reflecting a 4 percent abandonment level. For durum in Montana and North Dakota, it pegged planted acres at 1.75 million, with expected harvested acres at 1.7 million, just 3 percent abandoned. If final harvested area ratios fall to levels seen in 2002 across the region, there is another 1 million acres that need to be taken out from final production equations. This is a significant number, and some producers say it will be even higher.

Emotions are high this growing season, especially for producers in the heart of the severe drought conditions. The unexpected higher yield estimate and decline in prices since the beginning of July due to several factors has intensified these emotions. The wheat tour result is just one piece of information the markets react to. Two of the three days of the tour, the market moved higher, with analysts citing other factors as well, such as technical sell points, corn and soybean weather forecasts, and the start of spring wheat harvest impacting trends. The final harvest and yield report from producers themselves, as well as a full recognition of abandoned acres, and both domestic and international demand factors, will be the final driving forces in establishing the value of the 2017 crop.

When the full extent of the drought-impacted production areas is considered, it certainly appears the tour overestimated both spring wheat and durum yield potential in 2017. For durum, it is significant since likely two-thirds of the main region was not part of the survey routes. For spring wheat, it may not be as significant because there is strong yield potential in the eastern third of [North Dakota and] into Minnesota that will offset some, but not all, of the reduction in harvested acres in the west … Tour organizers have noted the strong negative reaction from producers from the final tour yield results. And also heard from the NDWC and producers during the tour about concerns over the lack of accounting for abandoned acres and lack of field counts in western areas. It will lead to some reevaluation of routes in future tours, or recognition of the need to weight yield counts to better account for significant crop condition difference between regions.

The tour has been conducted for more than 20 years, and has provided a great opportunity to build connections between producers in this region and some of its most important customers. This year may have added some challenges, but it also provides an opportunity to expand communication along all segments of the industry. Milers and other end-users of wheat grown in our region need to have producers be successful, for them to be successful.