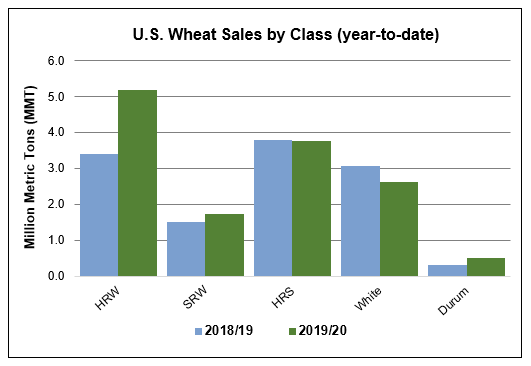

Three and a half months into marketing year 2019/20, total U.S. export sales* as of Oct. 15 of 13.8 million metric tons (MMT), 14 percent ahead of last year’s pace. Sales to four of the top 10 U.S. wheat customers are ahead of last year’s pace. Export sales to Mexico, the top U.S. customer over a five-year period, are up 50 percent year-over-year at 2.09 MMT. Sales to Nigeria total 936,000 metric tons (MT), up sharply from the 569,000 MT sold this time last year. All U.S. wheat classes except hard red spring (HRS) and white wheat are ahead of last year’s pace. USDA projects 2019/20 U.S. wheat exports will rise to 25.9 MMT. If realized, this would be 1 percent higher than 2018/19.

HRW. USDA reported hard red winter (HRW) year-to-date exports at 5.13 MMT, 52 percent ahead of the 2018/19 HRW sales pace on the same date. Mexico is currently the number one HRW purchaser and HRW sales to Mexico are 54 percent ahead of last year’s pace. As of Oct. 10, HRW sales to Mexico totaled 1.27 MMT. Sales to Nigeria are more than double last year’s pace at 567,000 MT. Japanese HRW purchases total 488,000 MT, up 7 percent from 2018/19.

SRW. 2019/20 soft red winter (SRW) sales are up 14 percent year-over-year at 1.72 MMT. Sales to 4 out of 5 of the top buyers of U.S. SRW are ahead of last year’s pace. Year-to-date, Mexico has purchased 550,000 MT, 15 percent more than last year. Nigerian SRW purchases total 142,000 MT, 50 percent ahead of last year’s pace. Sales to other Latin American countries, including Trinidad and Tobago and Panama are also ahead of 2018/19 exports.

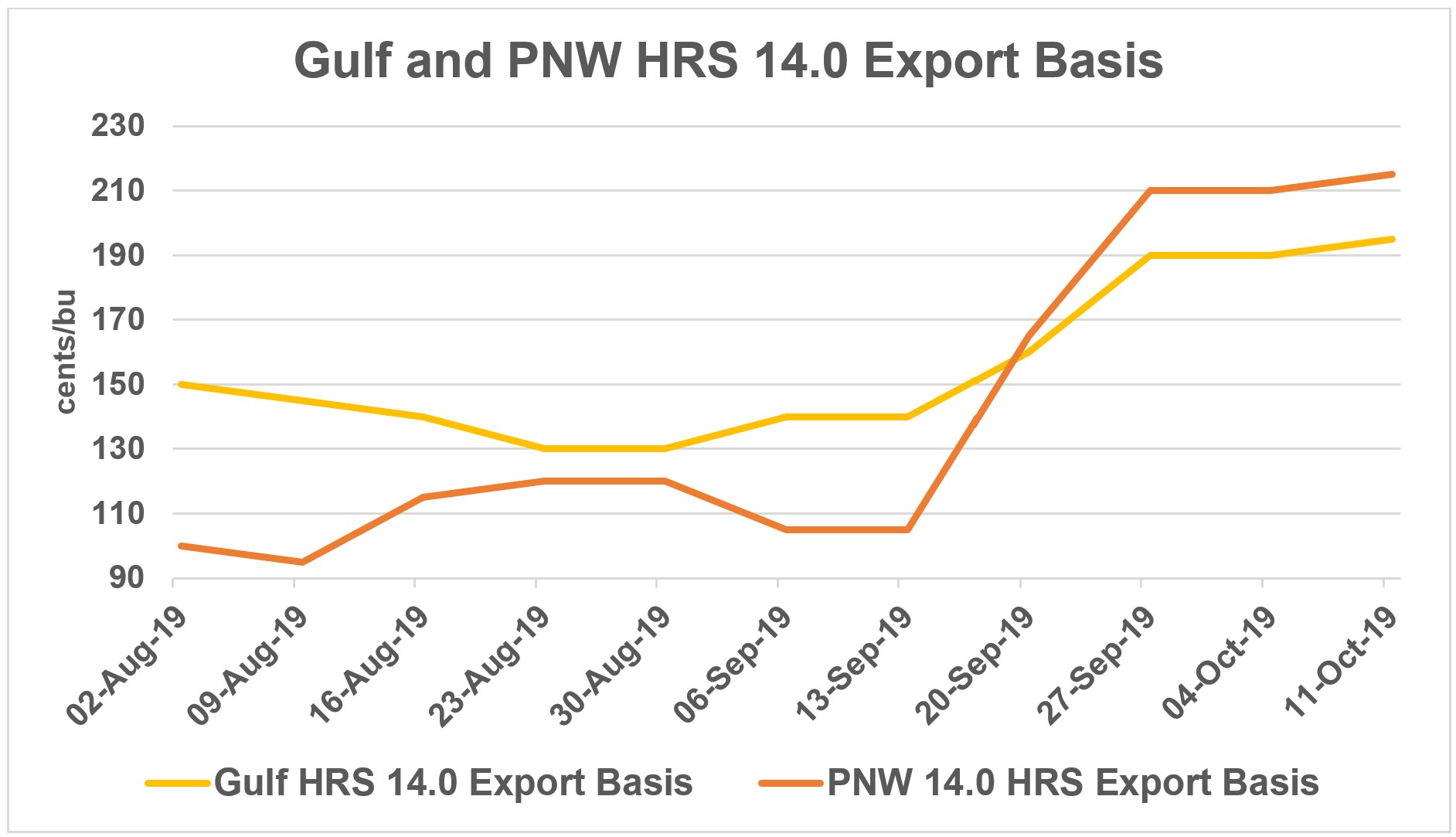

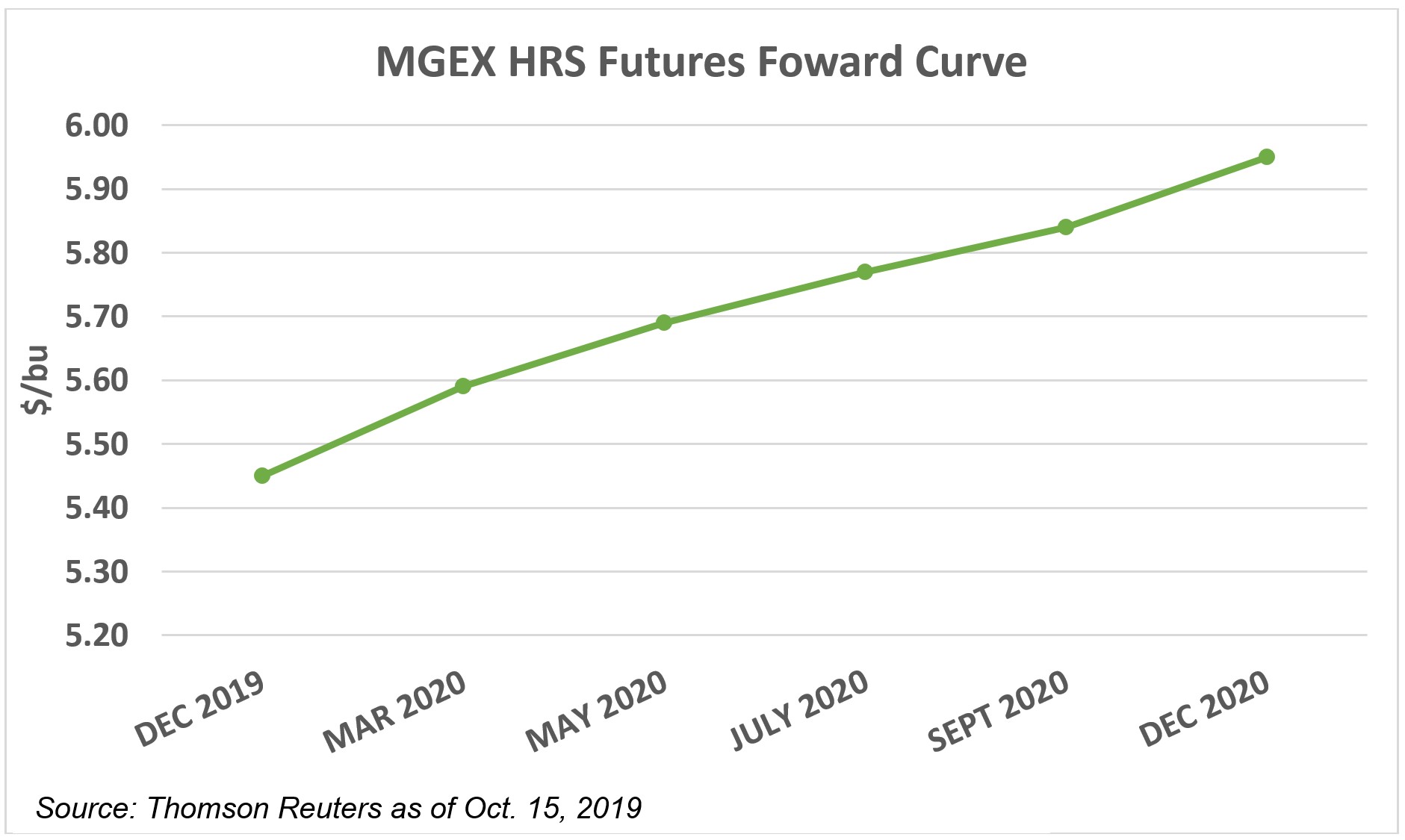

HRS sales of 3.77 MMT are only 1 percent behind the last year’s pace. As of Oct. 10, buyers in Taiwan purchased 353,000 MT, up 5 percent from 2018/19. Taiwan is the third-largest buyer of HRS. Sales to South Korea, the fourth-largest buyer of HRS, are up 10 percent from last year at 294,000 MT. Year-to-date sales to Southeast Asian countries, including the Philippines, Bangladesh, Thailand and Malaysia, are behind last year’s pace. This time last year, there were no HRS sales to China. So far in 2019/20, the U.S. has sold 63,000 MT of HRS to China.

White. As of Oct. 11, exports of all white wheat (including soft white and hard white) are down 14 percent year-over-year at 2.62 MMT. Sales to 4 out of the top 5 customers of U.S. white wheat are down from last year. Sales to the Philippines, the largest customer of soft white (SW) wheat, are down 6 percent from 2018/19 at 660,000 MT. SW food aid donations to Yemen are up 79 percent from this time last year at 231,000 MT. Minimal access to the Chinese market is also impacting SW sales. In 2017/18, China had purchased 271,000 MT of SW by this date.

It should be noted that the white sales to Nigeria of 123,000 MT are hard white (HW). USDA does not differentiate between the 2 classes on the Export Sales Report. HW sales to Nigeria in 2019/20 are 9 percent ahead of last year’s pace.

Durum. Year-to-date durum exports total 497,000 MT, up 59 percent from the same time last year. To date, the European Union (EU), Algeria and Nigeria are the top durum buyers. Year-to-date sales to the EU total 269,000 MT (9.88 million bushels), more than double last year’s pace. Italy is the top durum buyer in the EU. U.S. durum sales to Italy are up 165 percent from last year at 248,000 MT. Increased sales to the EU more than offset decreased sales to Algeria and Nigeria. Algerian durum sales are down 30 percent from last year at 45,000 MT and Nigerian durum sales are down 58 percent from 2018/19 at 28,000 MT. There is also a significant portion of these 2019/20 durum sales currently designated as “sales to unknown destinations.”

*U.S. Wheat Associates (USW) publishes a new Commercial Sales report every Thursday documenting wheat export sales-to-date by country and class for the current marketing year compared to the previous marketing year on the same date. The report also includes a 10-year commercial sales history by class and country. Data is sourced from the USDA Foreign Agricultural Service Weekly Export Sales Report.