Major organizations supporting the U.S. commitment to international food aid this week confirmed that U.S. wheat remains their most donated crop for monetization and feeding assistance. Representatives from World Food Program (WFP) USA, the U.S. Agency for International Development (USAID) and the International Food Assistance Division of USDA’s Foreign Agricultural Service provided that information at a meeting of the U.S. Wheat Associates (USW) Food Aid Working Group Nov. 10.

WFP USA is the U.S.-based organization associated with the United Nations World Food Programme (WFP) which was awarded the Nobel Peace Prize for 2020 “for its efforts to combat hunger, for its contribution to bettering conditions for peace in conflict-affected areas and for acting as a driving force in efforts to prevent the use of hunger as a weapon of war and conflict.”

USAID “leads the U.S. Government’s international development and disaster assistance through partnerships and investments that save lives, reduce poverty, strengthen democratic governance, and help people emerge from humanitarian crises and progress beyond assistance.”

FAS’s non-emergency food aid programs help meet recipients’ nutritional needs and support agricultural development and education. These food assistance programs, combined with trade capacity building efforts, support long-term economic development and help countries make the transition from food aid recipient to commercial buyer.

At the meeting, Rebecca Middleton, Vice President of Public Policy and Advocacy, and Jane Shey, Senior Policy Consultant with WFP USA noted that U.S. farmer engagement is very important to the organization’s mission, which relies heavily on both public and private donations. Shey acknowledged wheat farmers and the USW Food Aid Working Group specifically.

“I think it is important to say that one of the first shipments of food aid our organization made was in 1961 after an earthquake in Northern Iran, and it was 1,500 metric tons of U.S. wheat,” she said.

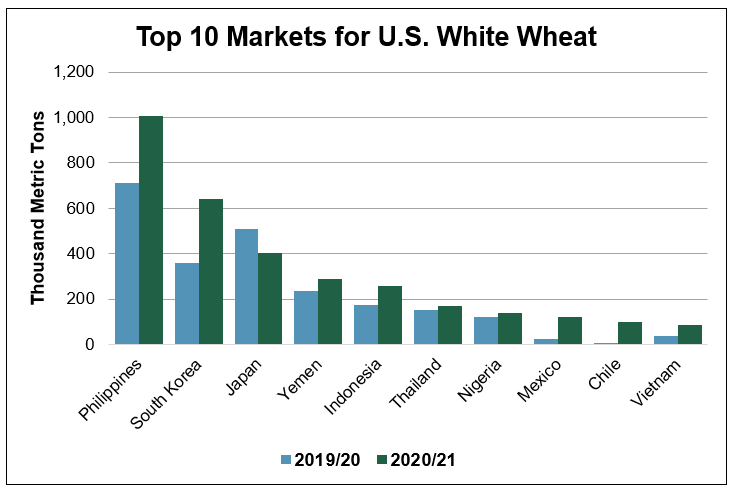

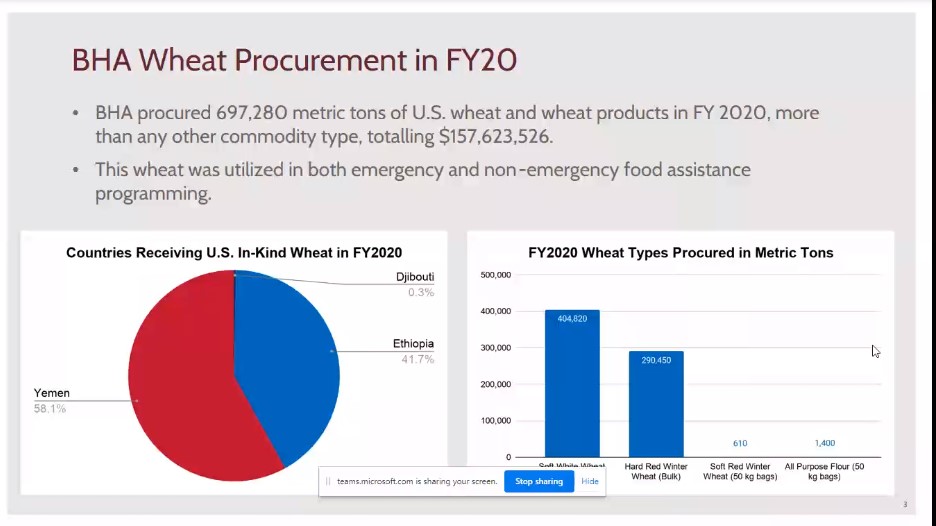

Katie McKenna, Policy and Program Coordinator Officer with USAID, reported that USAID’s Bureau of Humanitarian Assistance (BHA) has procured 697,280 metric tons of U.S. wheat, including a small amount of flour, in fiscal year 2020. That represents nearly 47 percent of all commodities purchased by BHA and makes wheat the largest commodity used in emergency and non-emergency food assistance. Of that total, more than 58 percent was in-kind soft white wheat destined for Yemen. The organization also sent U.S. hard red winter wheat and flour to Ethiopia (41.7 percent of the total) and Djibouti.

The USAID Bureau of Humanitarian Assistance (BHA) relies heavily on U.S. wheat for in-kind food donations.

Unfortunately, there is no let-up in the need for food assistance in the world.

“Food security is not improving,” McKenna said. “Natural disasters, conflicts and now the COVID-19 pandemic have increased the vulnerability of millions. Yemen is the best example and I believe our agency and the World Food Programme are doing heroic work providing and distributing food for 8.2 million people there.”

In fact, on Nov. 6, USAID announced that it intends to grant $20 million to the WFP to purchase approximately 65,600 metric tons of wheat for the people of Sudan to help alleviate shortages of flour and bread in the Khartoum region.