Recent news and highlights from around the U.S. wheat industry.

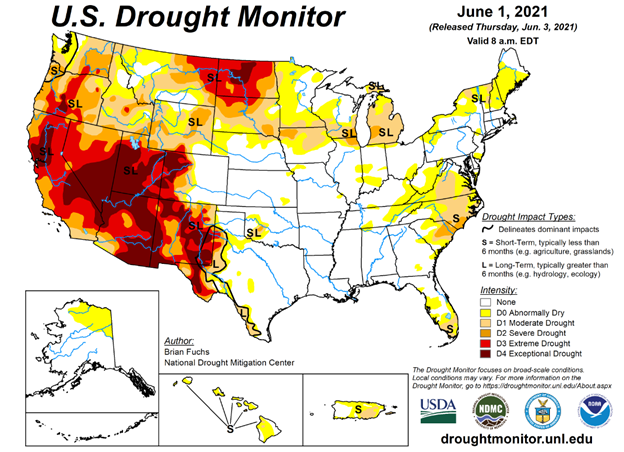

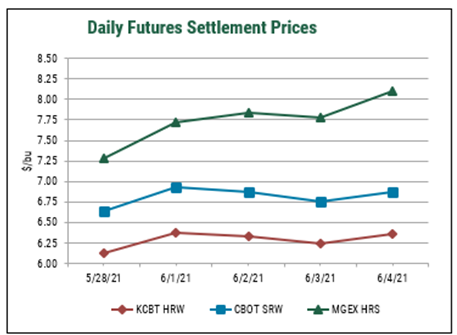

Speaking of Wheat. “Jumping from colder than usual temperatures to high heat, crop conditions are unlikely to stay this favorable for long, especially if drought conditions worsen. These weather shocks are likely to impact estimates for crop supply in the 2021/22 marketing year as demand continues to increase and push prices toward their highest levels since 2013.” – Shelby Myers, Economist, American Farm Bureau Federation. Read more here.

USDA’s New WASDE Report released 6/10/21 raised 2020/21 U.S. exports by 544,366 MT to 26.81 MMT. USDA also estimates larger U.S. wheat supplies, higher domestic use, unchanged exports, and slightly lower stocks for 2021/22. All wheat production is now projected at 51.66 MMT on increased HRW and SRW production, offsetting lower white winter production. The global wheat outlook for 2021/22 is for larger supplies, higher consumption, increased trade, and higher stocks. Global production and use are expected to set new record highs in 2021/22. U.S. Wheat Associates (USW) will update its World Wheat Supply and Demand Report this week.

Creating Value of U.S. Wheat: Through Solvent Retention Capacity. Registration is open for USW’s next monthly technical webinar on June 16. This webinar series provides technical guidance to add value for customers as they make their wheat purchasing decisions. USW technical experts Roy Chung and Tarik Gahi will discuss using SRC analysis as a tool for product quality, with fresh insights into SRC methods, solvent preparation and troubleshooting. Register for the webinar here.

Montana Wheat and Barley Committee is Hiring. The Montana Wheat and Barley Committee (MWBC) is recruiting to fill its Market Development & Communications Specialist position. This position is responsible for the administration of MWBC’s market development activities, as well as content development, communications and outreach efforts. Learn more about the position and how to apply here.

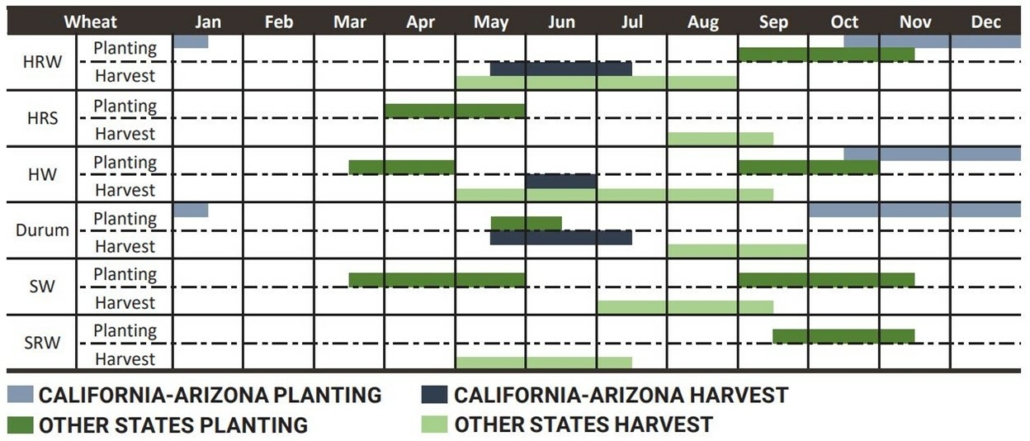

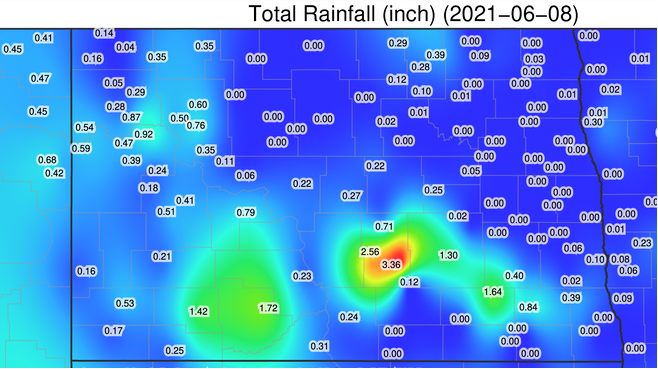

The 2021 U.S. Wheat Harvest is underway. USW publishes its Harvest Report every Friday afternoon, Eastern Daylight Time, throughout the season with updates and comments on harvest progress, crop conditions and current crop quality for hard red winter (HRW), soft red winter (SRW), hard red spring (HRS), soft white (SW) and durum wheat. Subscribe to receive the report directly to your inbox here. Follow along on social media using #wheatharvest21.

U.S. Wheat Associates Publishes Commercial Sales every Thursday, documenting wheat export sales-to-date by country and class for the current marketing year compared to the previous marketing year on the same date. The report includes a 10-year commercial sales history by class and country. Data is sourced from the USDA Foreign Agricultural Service Weekly Export Sales Report. Read the latest report on the USW website.

Subscribe to USW Reports. USW publishes various reports and content that are available to subscribe to, including a bi-weekly newsletter highlighting recent Wheat Letter blog posts, the weekly Price Report and the weekly Harvest Report (available May to October). Subscribe here.

Follow USW Online. Visit our Facebook page for the latest updates, photos and discussions of what is going on in the world of wheat. Also, find breaking news on Twitter, video stories on Vimeo and more on LinkedIn.