By Keith Good, Farm Policy News, Reprinted with Permission

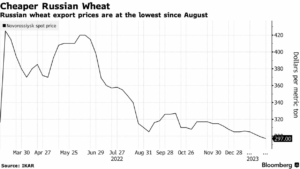

Late last week, Bloomberg writers Aine Quinn and Megan Durisin reported that, “After a slow start to the season, Russia’s grain exports are booming as buyers load up on its attractive bumper supplies.

“The country’s shipments of wheat — its main crop — almost doubled in January and February from a year earlier, Logistic OS data show. Buyers shunned cargoes earlier in the season when prices weren’t as appealing, but are now returning as last year’s massive harvest helps Russian grain to rank among the cheapest globally.

Chart Source: “Russia Wheat Exports Nearly Double What They Were Before War,” by Aine Quinn and Megan Durisin. Bloomberg News (March 3, 2023).

“The recent boom shows shippers have overcome some of the financing and insurance problems fueled by sanctions on Russia. The outlook for exports from the Black Sea is also coming into sharper focus as a deal allowing Ukrainian cargoes to sail through a safe corridor comes up for renewal in about two weeks. Supplies from both nations are helping to stop global food inflation worsening.”

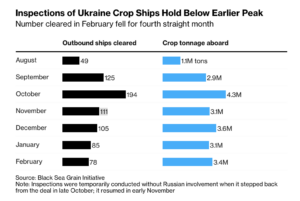

The Bloomberg article also noted that, “While Ukraine’s volumes remain significant, they’re below peaks set late last year. The amount carried out of the Black Sea in February totaled 3.35 million tons and the number of vessels cleared for inspection — a part of the deal — fell for a fourth month.

Chart Source: “Russia Wheat Exports Nearly Double What They Were Before War,” by Aine Quinn and Megan Durisin. Bloomberg News (March 3, 2023).

Sluggish Inspectors

“Kyiv has blamed a slowdown in its exports since late last year on sluggish work by Russian ship inspectors, who are one of the parties tasked with checking all vessels sailing under the deal.”

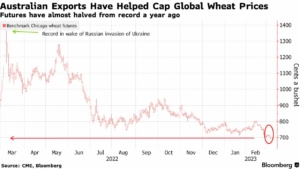

On Monday, Bloomberg writer Keira Wright reported that, “Australia, the world’s second-largest wheat exporting country, is likely to see shipments slump 20% from record levels in the coming financial year as production tumbles because of a shift to a drier climate pattern.

“Exports will probably fall to 22.5 million tons in 2023-24 from an all-time high of 28 million tons a year earlier, while output is set to decrease to 28.2 million tons from 39.2 million tons, government forecaster Abares said. The figure for the harvest just completed is up from 36.6 million tons estimated in December. Planting for the coming crop only gets under way in April.

Chart Source: “Australia Sees Wheat Exports Plunging 20% on Drier Climate,” by Keira Wright. Bloomberg News (March 6, 2023).

Aussie Production Price Cap

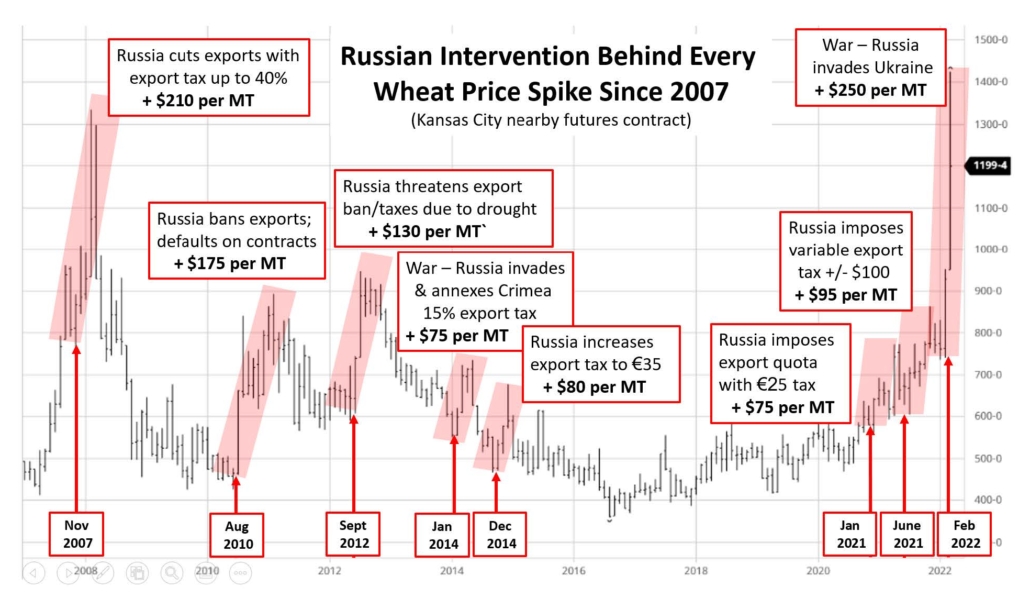

“Supplies of the food staple from Australia have helped to cap global prices in the past year after Russia’s invasion of Ukraine choked shipments and sent the grain to a record.”

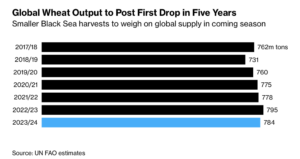

More broadly on global wheat production, Bloomberg writer Aine Quinn reported late last week that, “Global wheat output is expected to drop slightly next season from a record high as the war in Ukraine and dry weather in Russia takes a toll on crops, the United Nations said.

Chart Source: “UN Sees Global Wheat Output Falling for First Time in Five Years,” by Aine Quinn. Bloomberg News (March 3, 2023).

“Production should fall roughly 1% to 784 million tons in the 2023-24 season, the UN’s Food and Agriculture Organization said Friday. That would be the first decline in five years and highlights the risk that global grain supplies still face from Moscow’s invasion of Ukraine.”

Black Sea Corridor Negotiations

In more detailed reporting on the renewal of the Black Sea Grain Deal, Reuters writer Michelle Nichols indicated yesterday that, “United Nations Secretary-General Antonio Guterres will meet Ukrainian President Volodymyr Zelenskiy in Kyiv on Wednesday to discuss extending a deal with Moscow that allows the Black Sea export of Ukraine grains amid Russia’s war in the country.

“‘The Secretary-General has just arrived in Poland on his way to Ukraine,’ U.N. spokesman Stephane Dujarric said on Tuesday, adding that Guterres will discuss the continuation of the deal ‘in all its aspects and other pertinent issues.’”

“The 120-day deal, initially brokered by the United Nations and Turkey in July and extended in November, will be renewed on March 18 if no party objects. Russia has signalled that obstacles to its own agricultural exports need to be removed before it lets the Ukraine’s Black Sea grain deal continue.”

The Reuters article pointed out that, “Turkish Foreign Minister Mevlut Cavusoglu said on Sunday that Ankara was ‘working hard for the smooth implementation and further extension of the Black Sea grain deal.’”

And Reuters writer Pavel Polityuk reported yesterday that, “Ukraine has started online talks with partners on extending the Black Sea Grain Initiative aimed at ensuring Kyiv can keep shipping grain to global markets, a senior Ukrainian government source said on Tuesday.

“The source said Ukraine had not held discussions with Russia, which blockaded Ukrainian Black Sea ports after its invasion last year, but that it was Kyiv’s understanding that its partners were talking to Moscow.

“‘The situation with negotiations is rather complicated. Now a lot depends not on us but on the partners,’ said the source, who spoke to Reuters on condition of anonymity.”

On Feb. 17, 2023, USDA FAS Agricultural Attaché Alan Hallman and colleagues published a Global Agricultural Information Network (GAIN) report on China’s “

On Feb. 17, 2023, USDA FAS Agricultural Attaché Alan Hallman and colleagues published a Global Agricultural Information Network (GAIN) report on China’s “