A professional chef demonstrates methods for using U.S. wheat to make handmade noodles during a Wheat Foods workshop for volunteers in Taipei’s adult long-term care community. The October 2022 workshop was part of USW’s ongoing effort to develop new wheat food options for Taiwan’s aging populations.

While innovating new products for members of the youthful “Snackification Generation,” U.S. Wheat Associates (USW) has simultaneously been working to develop and promote specialty wheat foods designed for Earth’s more experienced generation.

The world’s older folks if you will.

A catchy nickname has yet to attach to the fast-growing group of consumers over 65, but tags like “Snacking Seniors” and “Aging Appetizers” miss the mark. That’s because instead of crackers, cookies and biscuits, new variances of noodles and breads and pastries are at center of USW’s efforts to grow demand for U.S. wheat in markets with aging populations.

“Super-aged” is the buzzword being used by the media, and a common prediction is that by 2030 there will be at least 30 countries where more than 20% of the population is over 65 – the ratio that has been set to define a super-aged country. Already, “There are more people on the planet over the age of 65 than ever before in human history,” the National Academy of Sciences, Engineering and Medicine recently reported, adding that, “Globally, the population aged 65 and over is growing faster than all other age groups.”

Recognizing opportunities to promote U.S. wheat in super-aged markets – notably its protein, B-vitamins, dietary fiber, and other nutritional benefits – USW has been engaging consumers to learn about preferences and learn what kind of products have a place in their diets and on their menus.

As it turns out, flour made with high-quality U.S. wheat has no age restrictions.

Asia: Super-sized, Super-aged

USW offices in Japan, South Korea and Taiwan have for years been preparing for expansion of aging populations. And for good reason. Nearly 30% of Japan’s population is over 65. and Taiwan (18%) and South Korea (17%) follow, both expecting to see those percentages rise dramatically in coming years.

Expected to become a super-aged society by 2025, Taiwan is a loyal customer of U.S. wheat, with a market share that has ranged from 70% to 80%.USW staff in the country has been aggressive about positioning U.S. wheat in the diet of senior citizens.

“The Taiwan Government noticed the trend and has made great efforts to help develop healthy foods for the elderly in the country, explained USW Taiwan Country Director Bo Yuan Chen. “However, most efforts had been in rice products. USW’s Taipei Office noticed the lack of wheat products for the elderly in Taiwan, so we launched a program to assist flour and wheat foods industries to develop more wheat products suitable for the elderly.”

Maintaining U.S. market share requires growing the level of wheat food consumption by older consumers, Chen said, adding. “To do this, USW has been working with flour millers, universities and wheat food manufacturer associations to conduct studies, provide technical support and facilitate product development for older consumers, the goal being putting more wheat-based products aimed at the needs of the elderly on food store shelves.”

Pan breads, soft European breads and noodles are the promising foods that U.S. wheat is working to promote to maintain demand by Taiwan’s coming super-aged society.

“U.S. wheat’s strength is in bread products, so that is where we are now focusing,” said Chen.

Workshops conducted by USW in Taiwan last year included trainings and the sharing of methods of cooking and baking wheat products that fit desires and needs of the country’s fast-aging population. USW is continuing its work in this area in 2023.

Asking Older Consumers What They Want

One major step taken by USW was to survey older Taiwanese consumers to determine preferences in wheat foods and what situations best motivated consumption of wheat foods.

Following the surveys, USW conducted outreach activities to further explore trends.

In October 2022, USW collaborated with Taiwan’s Department of Food and Beverage Management of Shih Chien University (USC) to conduct two Chinese Wheat Food workshops for an audience that included volunteers in Taipei’s adult long-term care community. A professional chef demonstrated methods for using U.S. wheat to make handmade noodles, pan-fried stuffed buns, silk thread rolls, sweet potato pastry, steamed bread, steamed stuffed buns and steamed twisted rolls.

The USW survey had indicated that older Taiwanese consumers favored wheat foods that “cut down on cooking time” or featured “no cooking” – thus, the pan-fried and steamed items.

A previous survey by USC found that more than 60% of Taiwanese over the age of 65 are dissatisfied with the Chinese-style wheat foods sold in the country.

“These workshops showed the participants how to make their own healthy and nutritious Chinese-style wheat products using U.S. wheat whole wheat flour,” USW Technical Specialist Wei-lin Chou noted. “It was a success, and we learned that volunteers from a long-term care community that participated in our workshop made those pan-fried stuffed buns for their elderly residents immediately following our workshop.”

In a separate workshop in October 2022, USW collaborated with the Department of Nutritional Science of Fu Jen Catholic University (FJCU) and Viva Bakery to conduct a healthy and sustainable bread development and promotion program. FJCU and a cooperating bakery applied 100% U.S. wheat flours and Taiwan local ingredients to make bread products.

Previous USW efforts in Taiwan included partnering with the China Grain Products Research and Development Institute (CGPRDI) to conduct research and corresponding workshops on topics such as, Taiwan Commercial Noodles Characteristics, Wheat Flour for Elders’ Noodles, Bakery Products Development for Elders and Steamed Bread Flour and Products.

A group photo at a workshop in Taiwan conducted by USW, the Department of Nutritional Science of Fu Jen Catholic University (FJCU) and Viva Bakery. The purpose of the workshop was to establish a healthy and sustainable bread development and promotion program.

A Solid Partner

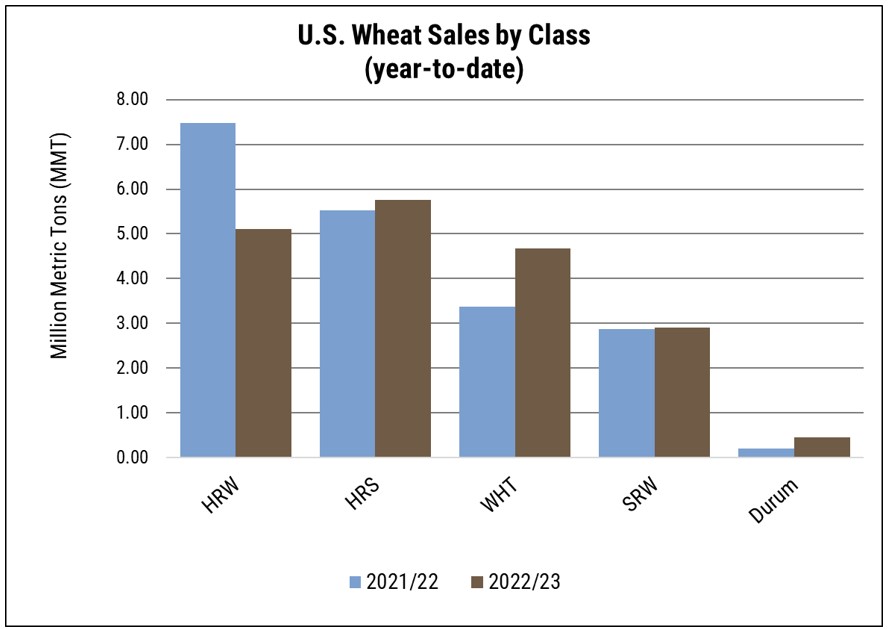

A reliable customer of U.S. hard red spring (HRS) wheat, hard red winter (HRW) wheat and soft white (SW) wheat, Taiwan is the 6th largest U.S. wheat export market and the 7th largest overseas market for U.S. agricultural products.

A special relationship has been built between U.S. wheat farmers and their Taiwanese customers.

“American farmers place great value on the relationship between U.S. agriculture and Taiwan,” USW Vice Chairman Michael Peters, who grows wheat in Oklahoma, said during a ceremony last fall in Washington D.C. in which the Taiwan Flour Millers Association (TFMA) signed a Letter of Intent to purchase 1.9 million metric tons of U.S. wheat in 2023 and 2024. “We pride ourselves as being dependable partners who grow the highest quality agriculture products in the world. The TFMA and its members have been great trading partners who fully recognize the value of purchasing U.S. wheat.”

Still, there is competition.

U.S. wheat competes against the ample and less-expensive supply of Australian wheat, which helps meet Taiwan’s robust demand for noodle flour. A consistent supply of U.S. hard white (HW) wheat is seen as a potential alternative – and a way for U.S. wheat to maintain and grow its share.

Each Asian Market is Different

Are there things to be learned from USW efforts in Japan and Korea to create demand for foods made with U.S. wheat in Japan or Korea?

“There are certainly common things we can share with flour millers and bakers about the quality of U.S. wheat, and the quality of the foods made with U.S. wheat,” said Chen. “But I think every country has its own different situation. We can learn from each other, but we also need to work hard to develop programs suitable for consumers in our own countries.”