Federal officials including U.S. Secretary of Agriculture Tom Vilsack joined Washington state lawmakers and university leaders in early August for the groundbreaking of a new U.S. Department of Agriculture-Agricultural Research Service (USDA-ARS) Plant Sciences Building on the Washington State University (WSU) campus in Pullman.

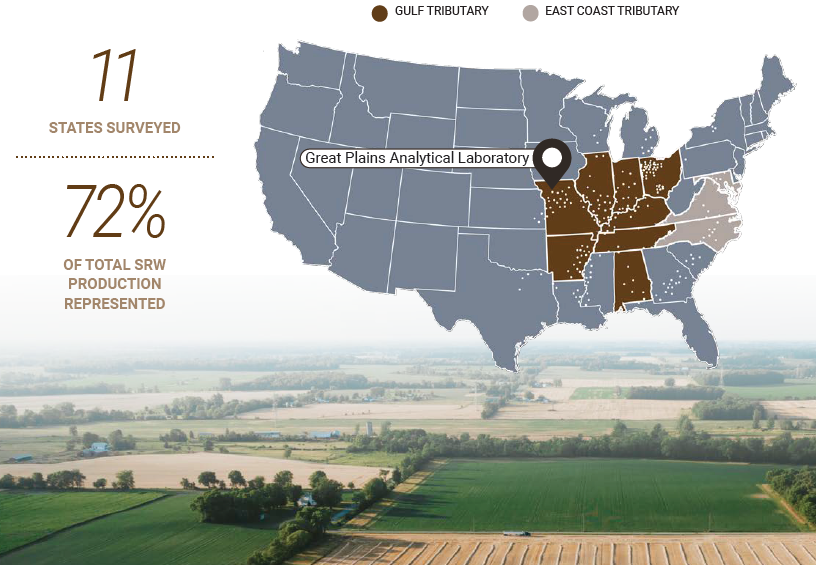

ARS is USDA’s “in-house research agency” focused on delivering scientific solutions to national and global agricultural challenges. ARS conducts wheat quality research through four regional Wheat Quality Laboratories (WQLs) focused on wheat types commonly grown in its region, including the Western Wheat Quality Laboratory also located at WSU. U.S. Wheat Associates (USW) has strong partnerships with each WQL as well as universities like WSU.

The new building at WSU is planned for opening in 2025. The WSU Plant Pathology, Crop and Soil Sciences, and Horticulture departments will inhabit the new building alongside federal scientists and four ARS research units: Wheat Health, Genetics and Quality; Grain Legume Genetics and Physiology; Northwest Sustainable Agroecosystems; and Plant Germplasm Introduction and Testing.

At the ground-breaking ceremony, more than 150 guests listened as speakers discussed the 20-year path to securing support for this new facility.

U. S. Secretary of Agriculture Tom Vilsack. WSU Photo.

Secretary Vilsack asked attendees to think ahead to a future when the facility is completed, bustling with students, faculty, and researchers looking to solve the problems facing farmers in Washington and far beyond.

“There’s an effort to try to make sure that we understand how to deal with a particular disease that is impacting wheat production. And imagine the spark, the passion, the energy, the excitement that occurs when the solution is discovered. That’s what this facility is about, that moment of discovery,” he said.

Vilsack noted the new facility will not only be a place for discovery but also a resource that farmers both local and far afield of the Palouse will benefit from in the form of new techniques and greater insight into the vital work they do.

“To the extent that we have a university and a government research entity in partnership, ensuring that farmer, that rancher, that grower, that producer, can continue to be productive is an enormous opportunity for this country, and each one of us should be thankful at this groundbreaking for the science that’ll take place that’ll help these farmers, ranchers, and producers continue to productive,” Vilsack said.

Elizabeth Chilton, the inaugural chancellor of the WSU Pullman campus, noted that the groundbreaking represented much more than the beginning of a new research facility.

“It is evidence of the incredible partnership that WSU celebrates with USDA and our local, state, and federal legislators, commissioners, and communities,” Chilton said. “The groundbreaking research that this facility will support will literally change lives. This building will support faculty members, students, and researchers partnering together to create better crops and more sustainable farming practices so that we’re able to better feed our planet.”

Washington Grain Commission Vice President Mary Palmer Sullivan (second from right) was among dignitaries and guests at the USDA-ARS Plant Sciences Building Groundbreaking ceremony on the campus of Washington State University Aug. 1, 2023. WSU Photo.

In addition to representatives from the federal government and Washington state agriculture groups (including Washington Grain Commission Vice President Mary Palmer Sullivan), WSU Board of Regents Chair Lisa Schauer and Regent Brent Blankenship, a Washington state wheat farmer and Past President of the National Association of Wheat Growers, also attended the events.

This article includes excerpts and photographs from an article in “WSU Insider” by RJ Wolcott. Read more here.