The 2023 U.S. hard red winter (HRW) growing season saw a mixed bag of conditions from another severe drought in the southern and central Great Plains to nearly ideal rain and temperatures in the northern plains and Pacific Northwest (PNW).

Total production, while still quite low historically, reached 16.4 million metric tons (MMT), a 13% increase from 2022. As for functional qualities, this is a sound crop that meets or exceeds typical HRW contract specifications and should provide high value to customers.

U.S. Wheat Associates (USW) reports hard red winter quality highlights for HRW grown in regions that supply feed into export facilities in the Gulf of Mexico and for export facilities in the PNW. The complete 2023 USW Crop Quality Report and detailed by-class reports are being produced now and will be posted online over the next few weeks.

Gulf-Exportable Hard Red Winter Crop Highlights

The average grade is U.S. No. 2 HRW with 84% of the crop grading No. 2 or better.

Test weights trended lower this year with an overall average of 59.7 lb/bu (78.6 kg/hl).

Kernel data indicate uniform and dense kernels with 69% exhibiting large size, a much higher level than in previous years.

Protein content average is 12.9% (12% mb), with 63% of Gulf samples 12.5% or higher.

Alveograph W average value of 260 (10-4 J) is exceptionally high for dough strength and an L value of 110 (mm) indicates very good extensibility.

Farinograph peak and stability averages of 4.9 and 8.9 minutes, respectively, are well within industry target ranges.

Average bake absorption is 64.6%, significantly higher than the 5-year average.

Average loaf volume is 936 cc, comparable to last year and indicative of excellent baking quality.

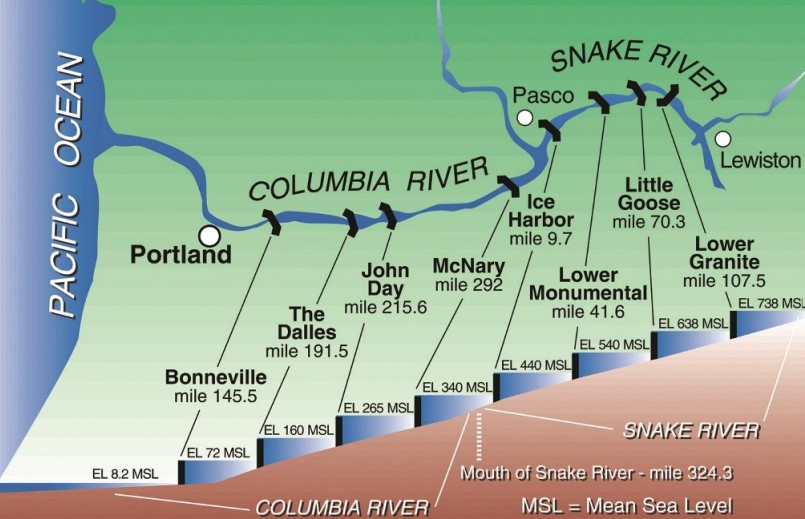

PNW-Exportable Hard Red Winter Crop Highlights

The average grade for the 2023 PNW-exportable crop is U.S. No. 1 HRW with 81% of samples grading No. 1 and 93% grading No. 2 or better.

PNW test weights trended slightly lower this year with an overall average of 60.7 lb/bu (79.8 kg/hl).

Protein content average is 11.8% (12% mb) with 59% of the crop 11.5% or higher.

Wheat moisture average is 10.4%, adding additional value for milling customers.

Kernel data indicate uniform and dense kernels with 69% exhibiting large size, which is a significant increase from last year and comparable to the 5-year average.

Alveograph W values were exceptionally high for dough strength at 296 (10-4 J) and the extensibility L values are high at 95 (mm).

Dough properties suggest an acceptable crop that is comparable to the 5-year average.

Loaf volume average is 868 cc, comparable to the 5-year average and above U.S. industry targets of 850 cc.

The final northern durum weekly report showed that compared to the prior week, wheat moisture increased to 11.4%, falling number increased to 416 sec and HVAC decreased from 81% to 80%. Compared to 2022, protein content, 1000-kernel weight, and percent damaged kernels were higher while falling number, test weight and shrunken and broken kernels were lower. The overall grade remained U.S. No. 1 Hard Amber Durum (HAD).

The final northern durum weekly report showed that compared to the prior week, wheat moisture increased to 11.4%, falling number increased to 416 sec and HVAC decreased from 81% to 80%. Compared to 2022, protein content, 1000-kernel weight, and percent damaged kernels were higher while falling number, test weight and shrunken and broken kernels were lower. The overall grade remained U.S. No. 1 Hard Amber Durum (HAD).