Market Offers Soft Red Winter Buying Opportunity

By Claire Hutchins, USW Market Analyst

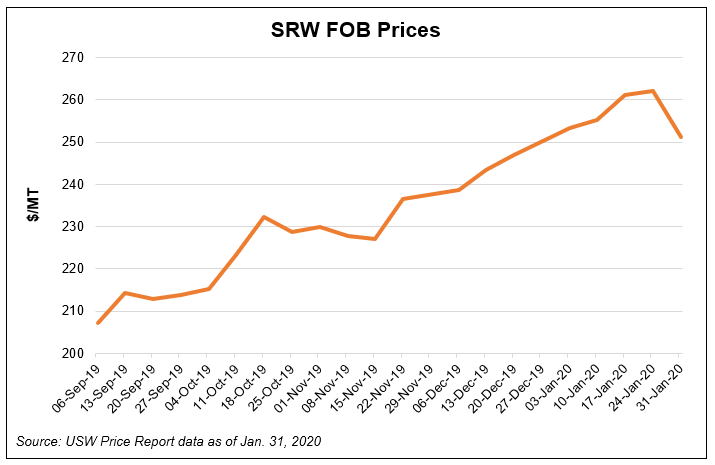

Soft red winter (SRW) export prices had been climbing steadily since the end of the 2019 harvest on reduced production, tight ending stocks and stable domestic and overseas demand. Then after Jan. 24, 2020, export basis and FOB prices dipped, offering an opportunity for SRW importers to lock in a lower price through the end of marketing year 2019/20.

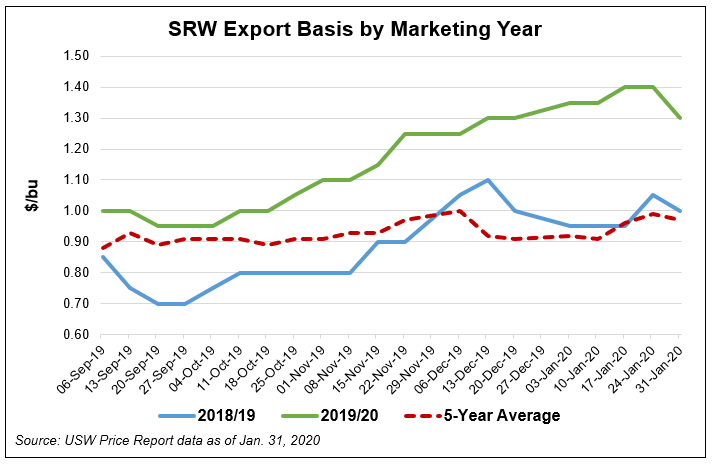

From mid-July 2019 to mid-January 2020, SRW export basis rose 65 percent from $0.85 per bushel (/bu) to $1.40/bu, 33 percent higher than last year at this time and 47 percent higher than the 5-year average.

However, between Jan. 24 and Jan. 31, 2020, a dip in export demand pressured SRW export basis for the first time since early September. SRW export basis fell 7 percent to $1.30/bu, the lowest since early December 2019. Lower basis and softer futures prices also pressured SRW FOB values 4 percent between Jan. 24 and Jan. 31 from $262/MT to $251/MT.

Market watchers, including those at U.S. Wheat Associates (USW), believe this price decline is a good buying signal. They believe SRW export basis will remain high through the end of 2019/20 based on still tightening exportable supplies and stable demand from overseas customers. Members from the grain trade also believe SRW export basis will be higher than average through the 2020/21 harvest based on significantly reduced beginning stocks year-over-year and substantial reductions in SRW planted area in states tributary to the Mississippi River, where a significant amount of SRW is transported from the countryside to export facilities in the Gulf.

Specifically, farmers reduced SRW planted area for harvest in 2019 due to overly wet field fields in the fall of 2018 and unprofitable prices. SRW production fell 17 percent from last year to 6.50 million metric tons (MMT), the lowest since 2010/11. USDA expects SRW ending stocks at the end of 2019/20 to fall 49 percent to 2.88 MMT, the lowest in 10 years. USDA predicts SRW exports will total 2.72 MMT, in line with the 5-year average.