How to Understand and Utilize the U.S. Wheat Associates Price Report

The U.S. farm families who produce wheat and the entire U.S. supply chain remain committed to operating a transparent and open market. How export prices are discovered is one of the reasons why our overseas customers know they can depend on the integrity of our supply chain, the quality of U.S. wheat and our unmatched reliability as a supplier. U.S. wheat export prices are discovered openly through futures exchanges and the cost to move wheat to the loading equipment at export elevators, and prices are always available to customers. In addition, private exporters use risk management tools to honor sales contract prices often made months in advance of vessel loading. However, we recognize that navigating U.S. export markets and making purchasing decisions is a complicated, risk-involved process, especially when wheat customers have so many options for sourcing their supplies. For many years, U.S. Wheat Associates (USW) has helped wheat buyers navigate this process and discover export prices by publishing its weekly wheat price report on its website.

What is the USW Price Report?

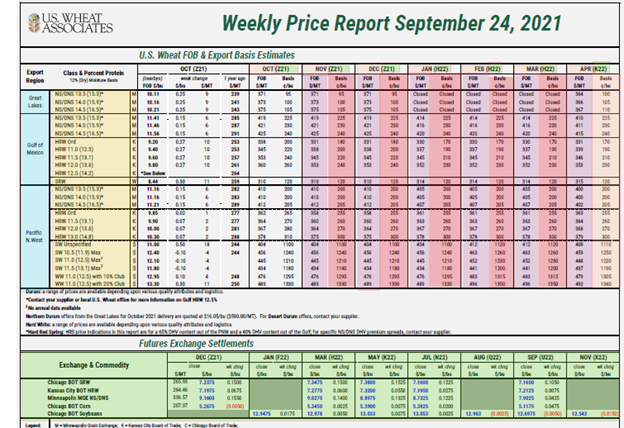

The weekly U.S. wheat export prices as reported by USW each Friday after wheat futures markets close are compiled through research from numerous market sources, including U.S. wheat exporters of all classes from various U.S. ports. The prices reported the Free on Board (FOB) estimated value of number two grade and the proteins indicated. They are not intended to represent offers nor should U.S. wheat importers rely on them as such. Additional factors may alter these prices significantly* and USW recommends that buyers maintain regular contact with suppliers to receive offers representing their requirements.

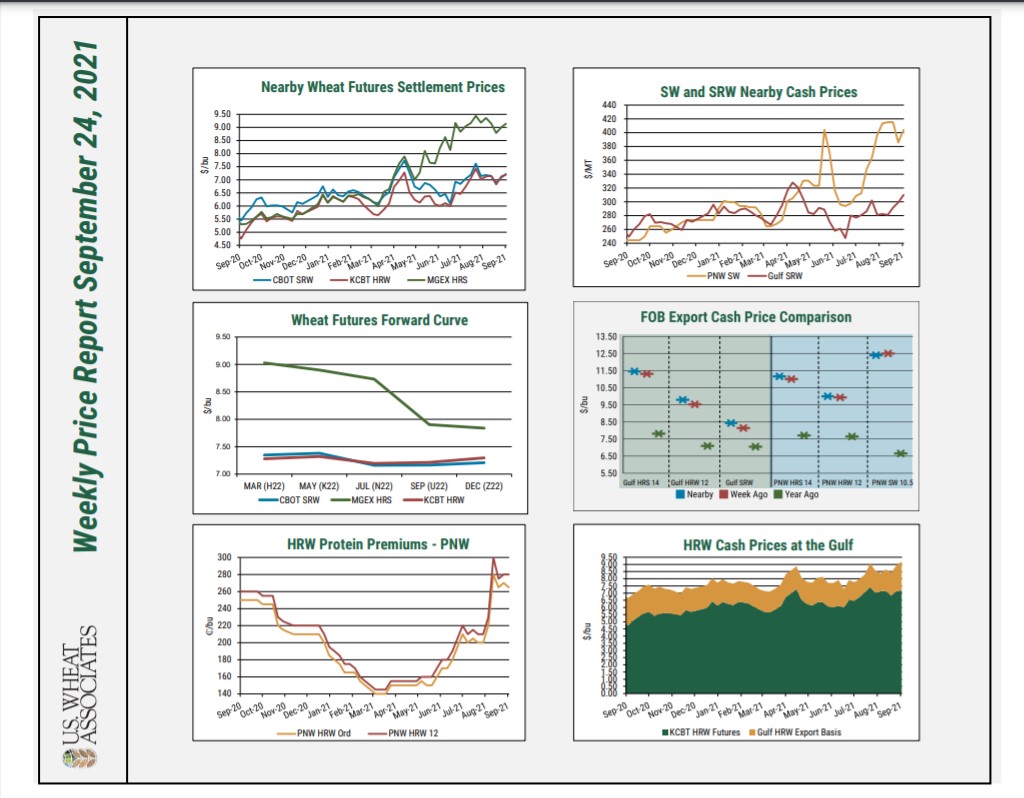

In addition to estimated prices of U.S. wheat by class (not including durum nor hard white wheat), protein level, export region and delivery period, Price Report also includes weekly futures prices select ocean rates and currency exchange rates, charts that provide context and market highlights that help buyers understand the market more thoroughly.

How is the USW Price Report assembled?

The USW Market Analyst begins by surveying export wheat company representatives trading the U.S. wheat classes from the Gulf, Pacific Northwest (PNW) and Great Lakes. The traders provide the week’s current basis, which is the difference between cash price offered for a commodity at a specific location and a futures contract price for that commodity. The basis is then added to the Friday closing futures price from the exchange on which the wheat class is traded: hard red spring (HRS) on the Minneapolis Grains Exchange (MGEX); hard red winter (HRW) on the Kansas City Board of Trade (KCBT); and soft red winter (SRW) on the Chicago Board of Trade (CBOT). PNW soft white (SW) and Western White correspond to the CBOT futures price. Expressed as an equation: Export Basis + Futures Price = Cash Price (FOB).

How to Read the Price Report

Posted below is the front page of a past Price Report, which has been color-coded to display the information featured in the report. The delivery month is in chronological order and details forward pricing. Each month also includes wheat futures month codes as follows: H=March; K=May; N=July; U=September; Z=December. The futures month codes are combined with the calendar year to show the futures price reference and delivery month.

For example, in the column Nov (Z21), “Nov” represents November delivery and Z21 represents the November delivery price based on the December 2021 wheat futures contract. To calculate the estimated export price of wheat in November, the November export basis, quoted in cents, in red, is added to the FOB price in green. The total is the FOB price, in purple.

More on Export Basis

Export basis can move up or down, affecting the export price of wheat, due to a variety of these factors. Some factors affecting export basis include transportation costs (trucking, barge, and rail rates), storage and elevation costs at export terminals, supply and customer demand, quality specifications, handling costs and profit margins, among other factors. Wheat export prices are also directly tied to movements in the futures market. In addition, export basis varies by exporting company, so USW Price Report basis prices represent an average of the shared quotes from traders.

Additional Resources in Each USW Price Report

Ocean Freight rates are included on the second page of each USW Price Report. Rates come from industry representatives each week and show many common vessel sizes and routes. A variety of charts are included in the USW Price Report to help customers visualize price trends. In addition, a Daily Futures Settlement Prices chart shows a week-on-week snapshot of the futures exchange.

Finally, on the last page of the Price Report, highlights that we have gleaned from several sources on potential market factors in the global wheat market help give meaning to price movements for the week. The futures highlight explains fundamental and technical factors affecting futures movement week-over-week. Export basis details the international and domestic conditions affecting basis movement by class and export region week-over-week. Highlights also include important information published by the USDA including crop progress and acreage, commercial U.S. export sales, U.S. Drought Monitor and foreign wheat marketing and production updates.

In the video below, a past USW Market Analyst shares a more detailed review of the USW Price Report, how it is assembled and how to understand and utilize the data.

An open, transparent pricing system is essential to a functioning global market and USW wants its customers to have as much information and tools available to them when making wheat purchasing decisions. Buyers should contact their suppliers to obtain prices based on their specific requirements and contract terms.

The weekly USW Price Report can be viewed here. Sign up to receive the report directly to your inbox every Friday by subscribing to the weekly USW Price Report email.

*These factors may include: (1) payment terms (differing from cash against documents which are the terms used in the U.S. Wheat Associates price report); (2) various quality factors, and method of quality certification; (3) loading terms (USW prices represent Free on Board and do not include loading rate guarantees, stevedoring costs or other elevator tariff charges); (4) different delivery periods than indicated in monthly prices reported by U. S. Wheat Associates.

By Michael Anderson, USW Market Analyst