Global Production Continues to Decrease Due to Weather Problems in Australia and Russia

By Claire Hutchins, USW Market Analyst

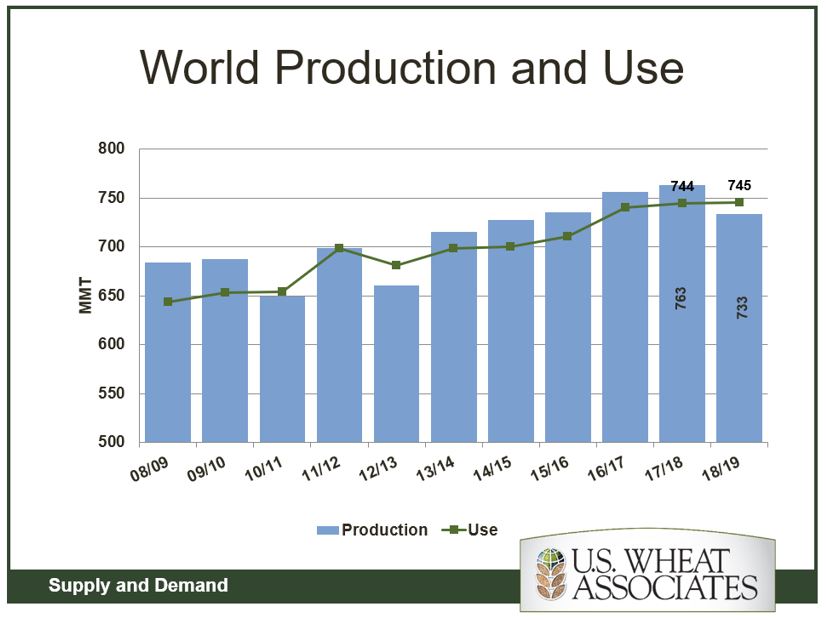

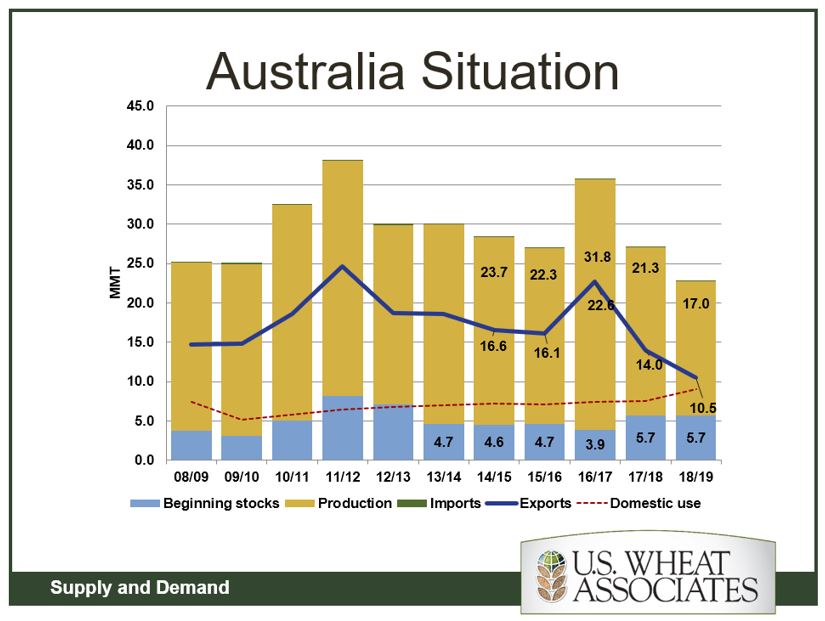

In its December World Agricultural Supply and Demand Estimates (WASDE) report, USDA predicted a 4 percent year over year decline in world wheat production for marketing year 2018/19, driven by severe drought in Australia and current cold, wet conditions in Russia. Australian production is expected to fall 32 percent below the 5-year average, the lowest level since 2007/08. Russian production is expected to fall 18 percent year over year, which would exceed the 5-year average by 6 percent.

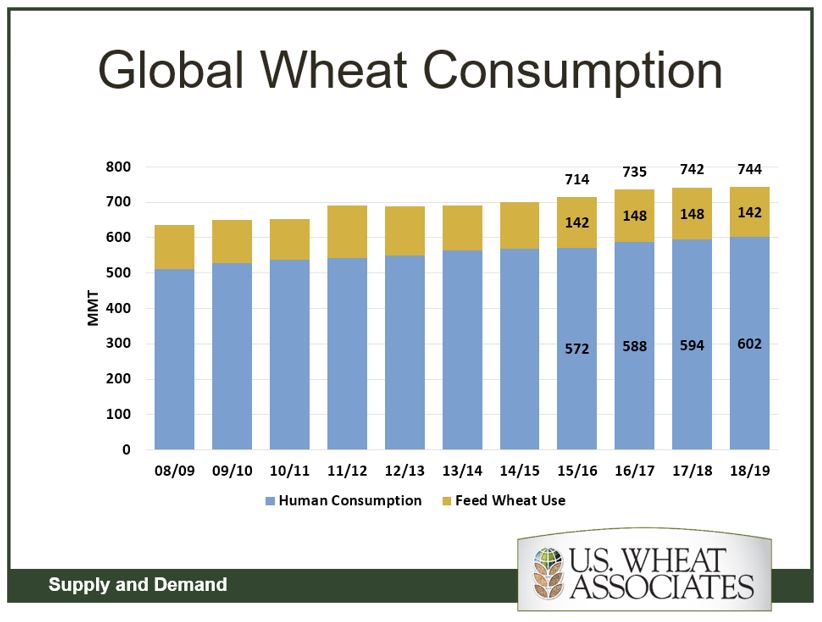

While USDA predicts a decline in global wheat production, it expects total wheat consumption to rise. This year, consumption estimates total 744 MMT, 4 percent above the 5-year average. Feed wheat consumption estimate is down 4 percent year over year, but human consumption is up 1 percent year over year and continues to drive overall consumption levels.

Australian drought is driving more than just production numbers. Exports are expected to decrease significantly year over year from 14 million metric tons (MMT) to 10.5 MMT. While production and exports decrease, Australian feed wheat consumption is expected to reach 5.5 MMT, 44 percent above the 5-year average. Total Australian consumption includes 61 percent feed wheat in 2018/19, up 8 percent from last year, as Australian producers struggle to support their livestock through the dry weather.

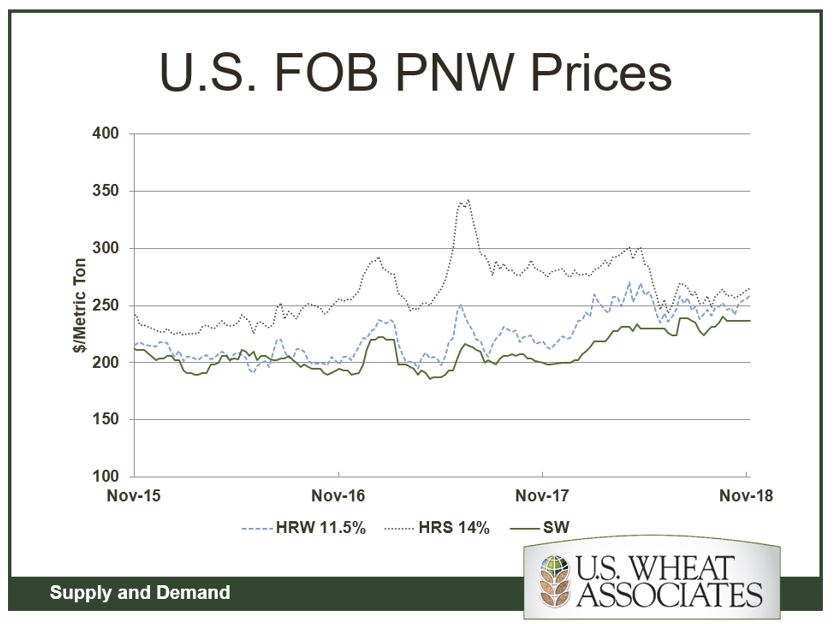

Pacific Northwest (PNW) free on board (FOB) prices have been relatively stable for the past few months. Soft white (SW) export price remains virtually unchanged from mid-October, while export prices for hard red winter (HRW) and hard red spring (HRS) are on the rise. With Australian exports shrinking, the United States increased exports to the Philippines, Thailand, and Bangladesh. Total exports to South Asia are up 18 percent year over year. The decline in global production and incline in global consumption will continue to support U.S. export prices in the coming months.

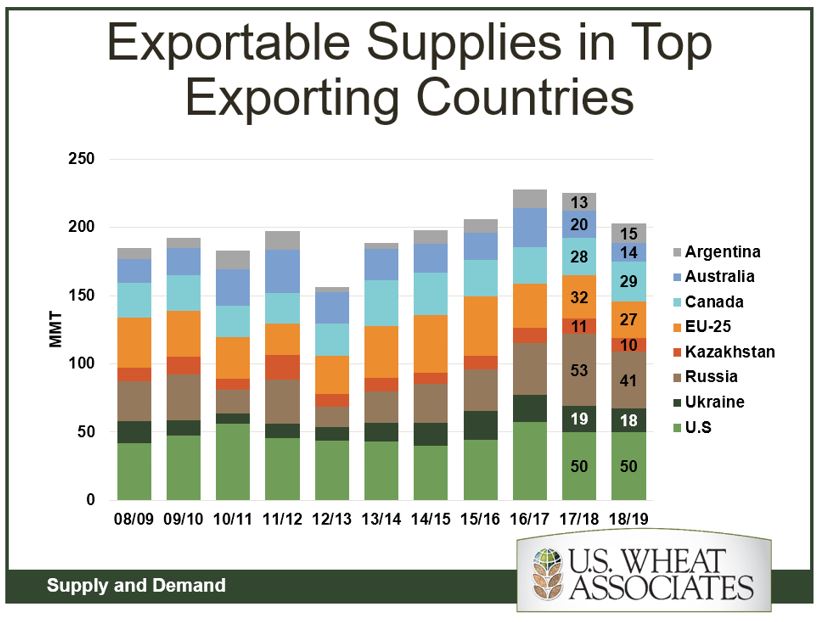

The United States holds the largest supply of exportable wheat in the world at 50 MMT. U.S. exportable supplies, as a percentage of top exporting countries, is up 25 percent year over year. While global production is shrinking, as always, U.S. wheat remains the world’s most reliable supply.